Contagion Increases with Silvergate-gate

The crypto markets faces another overhanging cloud this time called Silvergate

The crypto market is facing yet another potential systemic risk if Silvergate, one of the largest crypto-friendly banks, winds down its operations. As we noted in our previous newsletter, the bank recently announced that it may soon cease to be a going concern.

Despite this looming uncertainty, the markets are seemingly resilient, with BTC still trading above $22K. However, those who recall last year's insolvencies probably understand that caution is warranted during times like this. A classic letter to return to if you never read it is this one: If you see smoke, you better run....

The Bright Side of Things…

Silvergate has a significant client base, making it a viable candidate for yet another bailout or outright buy-out. There are rumors that several top institutions, including Citadel and Blackrock, are considering rescuing Silvergate.

But will this be enough to sustain the market’s recently renewed confidence? It’s difficult to say but for now, it remains positive that BTC still trades above $22k in the wake of this news and FED chairman Jerome Powell saying the FED is prepared to speed up the rate of rate hikes.

Bitcoin NFTs Hype Continues

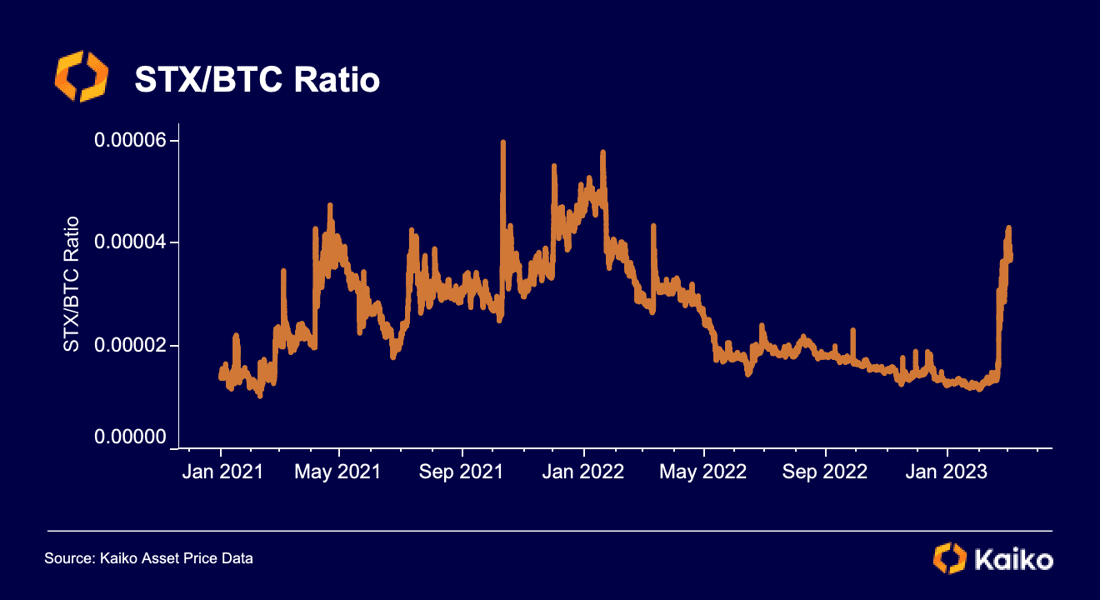

The Stacks token (STX) has experienced an impressive surge of over 125% in price over the last month, largely attributed to the ongoing excitement surrounding Bitcoin NFTs.

In recent weeks, the integration of NFTs onto the Bitcoin blockchain through Ordinals has sparked a frenzy of activity and debate among users. This same enthusiasm has now spilled over to Stacks, a Bitcoin layer for smart contracts that allows for the creation of decentralized applications and NFTs.

However, not everyone in the Bitcoin community is thrilled about using the leading digital asset for anything beyond monetary transfers. Some Bitcoin maximalists have voiced their opposition to this trend.

Noteworthy Mentions

Crypto Braces for Regulation in the US and Europe

The crypto regulatory landscape is changing at a rapid pace, and we are committed to keeping you informed. In our latest weekly article, we delve into how the US and Europe are adapting to these developments. This is a lengthy article covering all we know of the current state of regulatory developments.

Industry Shakers

Crypto Exchange Bybit Suspends USD Deposits

Crypto exchange Bybit announced last week that it would be suspending USD deposits for both national and international customers. This follows Binance's decision a month ago to halt USD transfers and an ongoing crisis at Silvergate, a California-based lender well-known for providing banking services to crypto firms and exchanges. However, users are still able to deposit and withdraw crypto from wallet addresses, as well as make purchases using credit cards and other payment methods.

Binance.US Is Operating 'Unregistered Securities Exchange,' SEC Official Says

The SEC staff believes that Binance.US is operating an unregistered securities exchange in the United States, according to a lawyer who spoke at a Voyager Digital bankruptcy hearing on March 3rd. William Uptegrove, a lawyer for the SEC, expressed concerns that Voyager's VGX token could be classified as a security under the law. In response to these allegations, Mark Renzi, the financial advisor for Voyager, released a statement earlier this week disagreeing with the SEC's claims.

BIS concludes experiment for cross-border retail CBDC architecture

Project Icebreaker, an initiative of the Bank for International Settlements and central banks of Israel, Norway, and Sweden, recently concluded research into the potential benefits and challenges of utilizing retail central bank digital currencies in international payments. The CBDC model developed by Project Icebreaker allows multiple foreign exchange providers to submit quotes to the system's hub, enabling end users to select the most cost-effective exchange rate.

Visa says the firm remains committed to its crypto strategy

Visa has maintained its dedication to its crypto strategy, in spite of a number of prominent crypto sector flops. This is in opposition to an earlier Reuters article that stated that the firm was putting off the introduction of certain crypto-related services and products until the regulatory environment and market conditions improve. Cuy Sheffield, Visa's head of crypto, refuted the Reuters report through a tweet, asserting that it was inaccurate.