Even though I've been involved in this industry for a long time now, I don’t believe you will ever get used to such drastic events as we witnessed the last few days. The reality is that crypto have faced similar situations many times in the past but the more the market matureness, the more devastating these kinds of events are for the entire industry.

I have no doubt that crypto will come out on top down the line. Surely the industry will face reputation damage (yet again) and surely there will be widespread ramifications following this.

Exchanges need to live up to the responsibility they are given by their customers. The only silver lining with this entire situation is that it will probably influence industry’s achilles heel to become stronger and more resilient in the future.

What happened?

It all started with an article by Coindesk that featured a breakdown of a balance sheet of Alameda Research. The majority of assets on their balance sheet were illiquid FTT tokens, which initiated a public discussion about the perhaps too-intertwined relationship between the exchange FTX and proprietary trading firm Alameda Research.

Then add in an intensifying rivalry between Binance and FTX, and a deadly catalyst was in place.

The key ingredient to FTX’s downfall is yet to be confirmed, but I think it is safe to assume by now that FTX sent a substantial amount of its own customer funds to its sister company Alameda Research. At least this is what reported by Reuters and other news outlets today.

The funds were sent most likely to consolidate Alameda Research as they are one of the largest holders of FTT. So in essence a play to protect one's own ass by protecting the entity that owns it.

Now comes the catalyst

Changpeng Zhao (CZ), the CEO of Binance received word that FTX had shed negative light on Binance in regulatory discussions. This, combined with him probably learning about the balance sheet imbalances, turned him to the keyboard to publicise his intention to sell out Binance’s enormous FTT exposure (footnote: Binance was a large backer of FTX in its early days and that equity was later converted to ~$2B worth of FTT).

What followed here was a cascading series of events that took down the whole crypto markets and blew FTX to pieces.

Following Binance’s public intention to sell FTT, investors of FTT quickly rushed to sell their own stake and run for the fire exit. This led to an extreme sell-off of FTT that spiraled out of control as evident from the chart below.

A failing token to the heart

The fall of FTT would in itself not be the end of the world for FTX had its downfall happened in isolation. I’ve witnessed at least a dozen times such “deathspirals” ending up losing momentum over the longer haul only to crawl back to life at a later stage. Given the strong position in the market and the highly profitable business of FTX, this would probably had been the case for FTT as well.

However, the sell-off combined with a strong narrative about disarray in the corporate balance sheets of both FTX and Alameda Research turned anxiety into panic in the matter of hours. CEO of Alameda Research, Caroline Ellisson, stepped in to reassure markets about the solvency of the company.

At the same time, SBF, stayed alarmingly silent, which did not provide much confidence to investors and the train of people looking to abandon FTT and withdraw funds from FTX could not be stopped. This is were things, and this is where things really went off the rails.

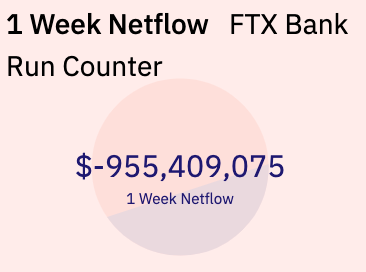

A visualisation made by analytics company Dune showed more than$1B of customer funds leaving the exchange over the last 7 days before the exchange halted the opportunity to withdraw capital.

At this point it was evident for everyone observing that there was something completely and utterly wrong and in reality the outflow was probably even higher than the figure displayed above.

Deal to be struck with….. Binance…?!

The silence was broken when SBF made a gigantic announcement, informing markets about the deal FTX had struck with Binance (non-binding legal letter).

This announcement came as a complete surprise to many (read: everyone). As a deal struck with Binance would signal answers to at least a few of the questions that were being raised.

Surely, FTX must have already ruled out other opportunities for emergency-funding before seeking a deal with Binance. Surely something must have been entirely wrong for them to resort to this last resort of salvation.

The market’s breathed a sigh of relief as CZ echoed the potential deal on Twitter.

However, as soon as the had a quick moment of relief, questions about antitrust started to surface, sending BTC back downwards reaching new yearly lows in valuation.

And less than a few hours after that, the first reports came out from insiders that Binance was strongly leaning towards walking away from the deal due to disarray in financials. The official announcement fell less than an hour after:

So what’s to happen?

It’s very difficult to speculate what will happen moving onwards from here. I am guessing that since FTX resorted so quickly to dealing with Binance, and the fact that Binance walked away so quickly from the deal, there is not much to save. The chance of another acquirer stepping in at this point seems like a low probability outcome.

And even if a deal should materialise and the investors and clients of FTX would be made whole, what is to happen to Alameda Research?

I think it is highly likely that the contagion we experienced following the Luna/3AC/Celsius blow-ups will come back in a similar fashion regardless of FTX securing the necessary liquidity to meet customer demands.

Another interesting take on the situation

Heck…. Lucas Nuzzi, head of R&D for Coinmetrics, even speculated on Twitter that Alameda Research did indeed blow up alongside Luna/3AC/Celsius but were kept alive by liquidity delivered by FTX. That would surely make sense given the order of events here and would also make Sam Trabucco’s departure with the CEO of Alameda Research quite timely, wouldn’t it?

In hindsight, Trabucco did signal he had not been part of effective management for some time already in August.

Contagion in the Making

It’s unclear how far and widespread the contagion from this will be but from what I can gather from public ressources, there’s quite a few names who could be on FTX’s creditor list.

Galaxy Digital seemingly with FTX exposure following their Q3 statement

Galaxy Digital's third quarter earnings report, released just a day after the FTX insolvency news broke, revealed a $76.8 million exposure to FTX.Solana facing big unwinds and head downwards

After taking a massive hit from the FTX/Alameda saga, Solana might be headed for another sell off event. The chain’s validators are scheduled to unlock 54.5 million SOL ($915 million) once the current epoch comes to an end today. Approximately 13% of the coin's circulating supply. Contrastingly, only 1.8 million SOL tokens will be activated for staking in the next epoch.Silvergate Bank potentially caught in the mix

Silvergate Capital (NYSE:SI) stock fell 5% in Wednesday's morning trading session as several traditional market experts and Web3 natives cautioned about the digital asset-focused bank's prospective credit exposure to the faltering FTX cryptocurrency exchange. While it has yet to be officially confirmed, investors are already getting cold feet; after all, anything is possible in the "wild west" of crypto markets.Tether CTO denying any contagion affecting USDT

Following the disclosure of FTX's liquidity issues, Tether CTO Paolo Ardoino has stated that the world's largest stablecoin issuer has no exposure to FTX or its sister firm Alameda Research. Ardoino reiterated this position in a response tweet to Wu Blockchain, noting that “Tether does not have any exposure to FTX or Alameda. 0. Null. Maybe is time to look elsewhere. Sorry guys. Try again.”

Proof of reserve movement coming to crypto?

Binance CEO Changpeng Zhao (CZ) and Kraken's Jesse Powell are among the heavyweights lobbying for this change, and both have indicated their support in recent tweets. Powell was quick to point out that Kraken is increasing the frequency and scope of their audits, but they are not yet foolproof. Meanwhile, CZ said that Binance will soon begin to do fully transparent proof of reserves.

Summary and Conclusion

Macro and crypto markets are ever evolving, new information tends to change trends faster than one can blink. One thing I've learned over the years is that the market often offers you smoke before you see fire. And when you as much as have a sensation of smoke in the making, it is time you run for the exit.

Yesterday’s outlook on the market was quite positive. Today is a different story.

I don’t think this is the end, even though we might see more skeletons coming out of the closet before this is fully over. If not because of contagion to other actors in the space surely because regulators are getting yet another reason to intervene with this industry. From what I can tell, the CFTC are already raising eyebrows about the ongoing FTX implosion.

So in short, the industry will persist but it seems we are ripe for another trip through the Tantrum yet again and could be due for another jump down the dumpster before the situation clears up.