Fear struck the market hard when the official inflation numbers from August surprised negatively (8.3% versus 7.9% expected by analysts) last week. Bitcoin and the rest of the crypto market followed suit selling off in great fashion when the news broke.

So here we are again!

Back in the dumpster with investor sentiment severely bearish again.

The markets are in disarray in multiple places, and until we see the dust settle in terms of a resolution for the Ukraine-situation or inflation getting under meaningful control, it is difficult to see any trend materialise.

So as boring as it is, my view upon the markets remain the same as when I published my first letter back in July this year. I continue to believe that the markets will trade sideways in a zig-zag manner.

Check my letter “Bad News is Good News for Bad News” where I elaborated on the above.

Macro Outlook

The equities markets are facing many headwinds. Inflation continues to run high, and because of it, central banks are forced to tighten the screw on the economy in an attempt to tame the situation. This happens in a time where we are facing a cyclical downturn and slowdown in growth, which means profit margins are being challenged in many sectors. Grim.

The situation invites skepticism and investors are left to ask themselves whether it is worth taking the risk being in exposed to risk-assets rather than sitting comfortably in cash at a time, where the cost of capital is increasing and rates are going up.

I need a Dollar, Dollar a Dollar is what I need… (Hey, hey!)

With everything including gold hanging on the ropes, the US Dollar continues to be king and has risen compared to practically all other foreign currencies. It is tempting to start speculating if a top in US Dollar is inching closer. However, with a looming energy crisis in Europe and a significant slowdown in growth for Chinese economy, I wonder what should stop the train?

Crypto Outlook

In my letters, I have mentioned many times how everything currently swings in parallel. As long as the macro picture continues to hold this many issues, it is difficult to focus on crypto in a vacuum. This is probably not to change anytime soon, and hence the crypto markets will probably also remain range bound for the time being.

However, during the last few weeks, several positive developments have happened lately, which could contribute to a brightened mood for crypto once the macro situation clears up.

Ethereum Merge finally happened

The long awaited Ethereum Merge finally materialised shifting the consensus mechanism in the heart of the protocol from proof-of-work to proof-of-stake. The transition redefines the fundamentals of the protocol, and makes it easier for Ethereum to compete with other layer-1 protocols that have had the luxury of a learning from Ethereum’s technical trade-offs and launching much later.

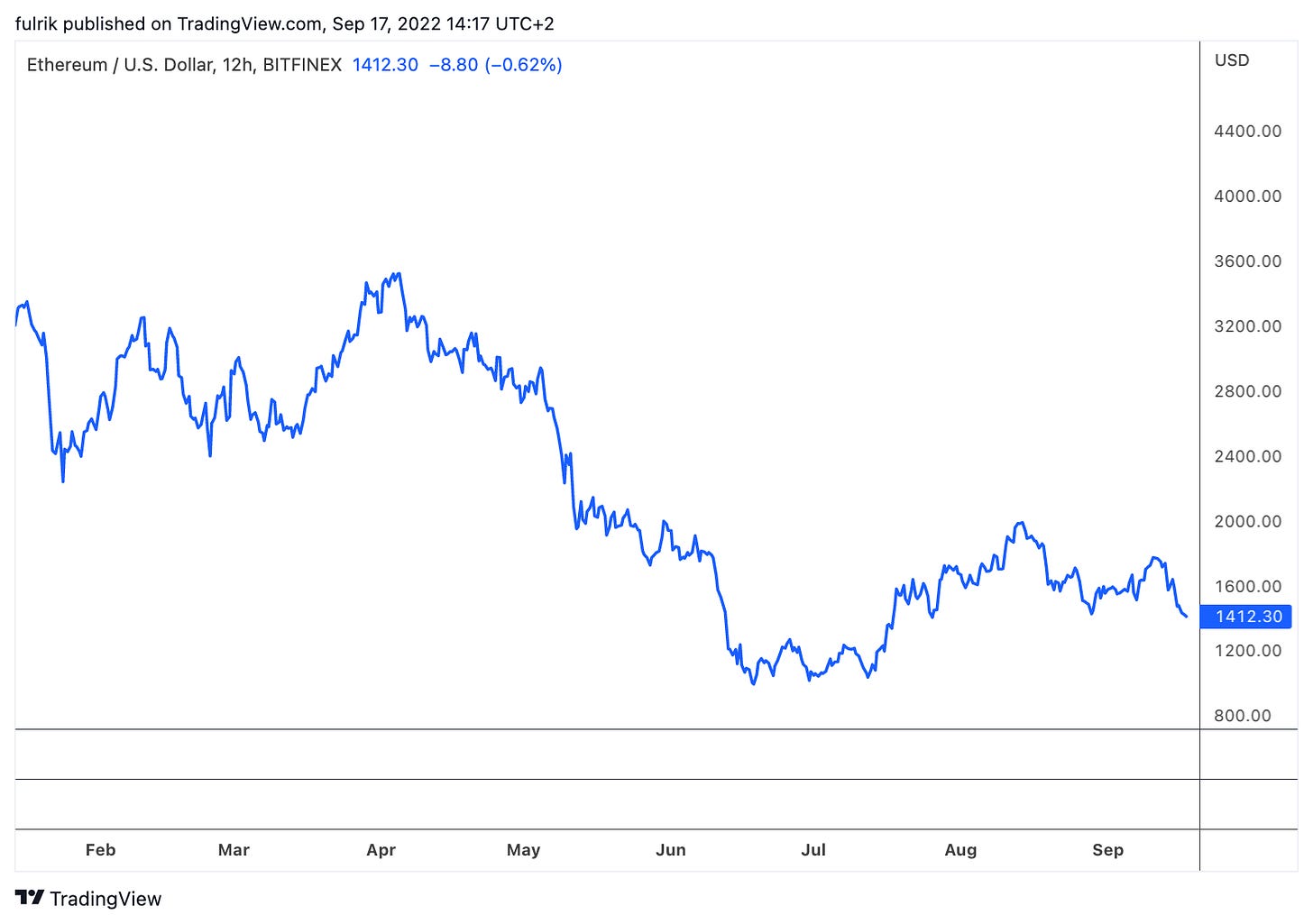

In terms of valuation, ETH saw a steady climb coming up to the day of the Merge, but immediately sold off after the transition had happened suggesting the success of the Merge was already priced in beforehand. A typical “buy the rumour, sell the news” type of event.

What is left to see for us now is a) if the protocol faces any technical hiccups over the next few weeks, and b) if any material support will show up for the chain of ETH that still runs on proof-of-work (now traded on several exchanges as $ETHW). So far both scenarios look unlikely.

The Merge concludes years of work within the Ethereum community and is an immense testament to the capability of the Ethereum developers. Kudos!

I don’t remember any accomplishment as monumental like this made in the open-source community for a long time.

Miners Stacking Sats

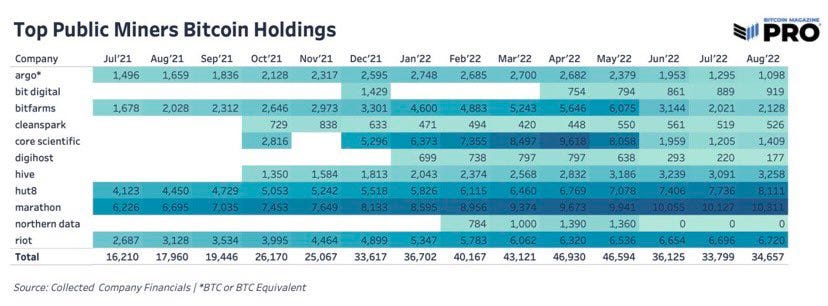

Since April this year, miners have consequently decreased their holdings of BTC. That trend could be reversing now as last month showed that miners increased their stock slightly again.

Worth mentioning is that the decline of the stock has happened while the hashing rate on the Bitcoin network was sitting close to all time highs. Miners may have sold out of their BTC but they did not turn off the machines!

Worth Highlighting

Adobe to acquire Figma for $20B

Not really crypto news, but could be the biggest acquisition of a privately owned company ever recorded. Figma’s valuation already up more than double since same time last year. Quite a ballsy move by Adobe but probably worth it.

South Korean court issues warrant for Do Kwon

A South Korean court has issued an arrest warrant against Do Kwon and five other members of the now defunct Terraform Labs. The chickens are coming home to roast.The Whitehouse publishes report on climate implications for crypto assets

With the climate debate becoming more and more central, it should come as no surprise that the conversation should sooner or later also entail crypto. Be prepared for massive misrepresentation. A fight for truth has begun.Microstrategy looking to purchase $500M worth of BTC

Microstrategy and Michael Saylor is looking to raise up to $500M in Class A shares to buy more BTC.Binance hires former Brazilian Central Bank President as advisor

The trend of regulatory experts sliding over to jobs in the crypto industry continues. If you can’t beat them, join them.

That’s it until next time!

P.S. If you happen to be in Zürich on the 21st of September consider popping by the Swiss Fund Day conference. I will be giving a presentation on Digital Assets.

Thanks for the info Ulrik 2.0 ! Hope to see more newsletters from you :)