Complacency is Still Not Warranted

Week and week again I have highlighted the importance of the macro environment surrounding crypto and how everything is correlated at the moment. Nothing trades in a vacuum.

This perspective just got re-affirmed as the crypto-markets went for a downward push following the Federal Reserve’s chairman, Jerome Powell, speech at the Jackson Hole Symposium.

At the meeting, Powell confirmed the FED’s hawkish stance on inflation and that the FED “[…] will keep at it until we are confident the job (i.e. killing inflation) is done.”

In other words, it seems safe to assume that the shorter term uptrends we have enjoyed over the summer should not cause complacency for any market participant let alone anyone in the crypto markets: The bigger picture has still not changed.

Inflation is still high. Markets have already taken a serious beating. There is no guarantee that further downside cannot be in the horizon. And while we all sit patiently and and wait for better data to act upon, investors will most likely remain hesitant for the time being and the market zig-zag will continue.

Crypto Outlook

Bitcoin, acting as one of the strongest indicators of the sentiment of the crypto markets, continues to trade very correlated with traditional financial assets.

A look towards the last three months of correlation with the S&P500 shows that BTC is swinging completely in sync with the rest of the market.

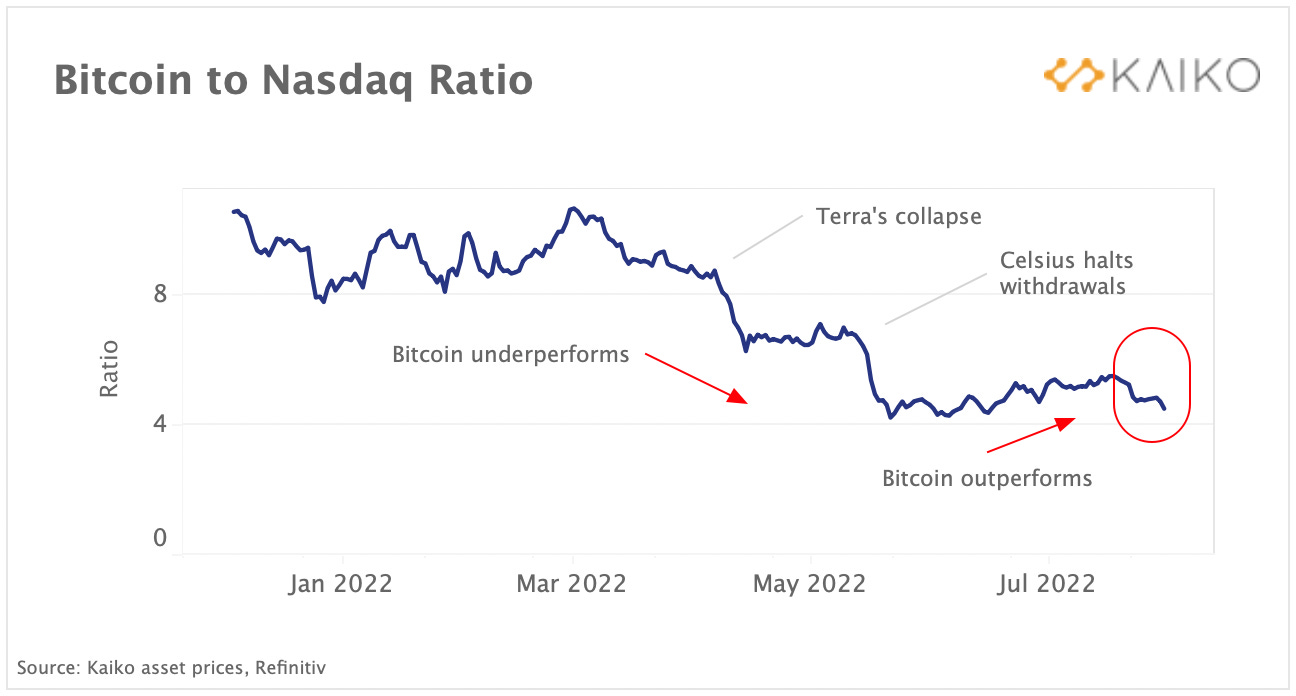

When looking at BTC’s performance to the Nasdaq there has also been a very strong correlation for a long time. In fact, BTC has even been underperforming the Nasdaq lately suggesting it acts on the same market conditions but as an even riskier asset. One could speculate this could be due to the anxiety in the markets following the Terra/AC/Celsius collapses.

All Crypto Swings in Parallel

For the last two months I have barely mentioned any other digital asset other than BTC in my letters. This is intentional as there has not been any noteworthy movements made by any crypto outside of BTC’s swings.

There is of course a few outliers to this and namely ETH seems to have made a few waves of its own likely due to the anticipation of its upcoming merge.

However, largely the waters have been dictated by BTC and as long as the godfather of crypto trades in such an indecisive way, I see no reason to participate in a whack-a-mole for other assets in the industry that will perform without having a real edge.

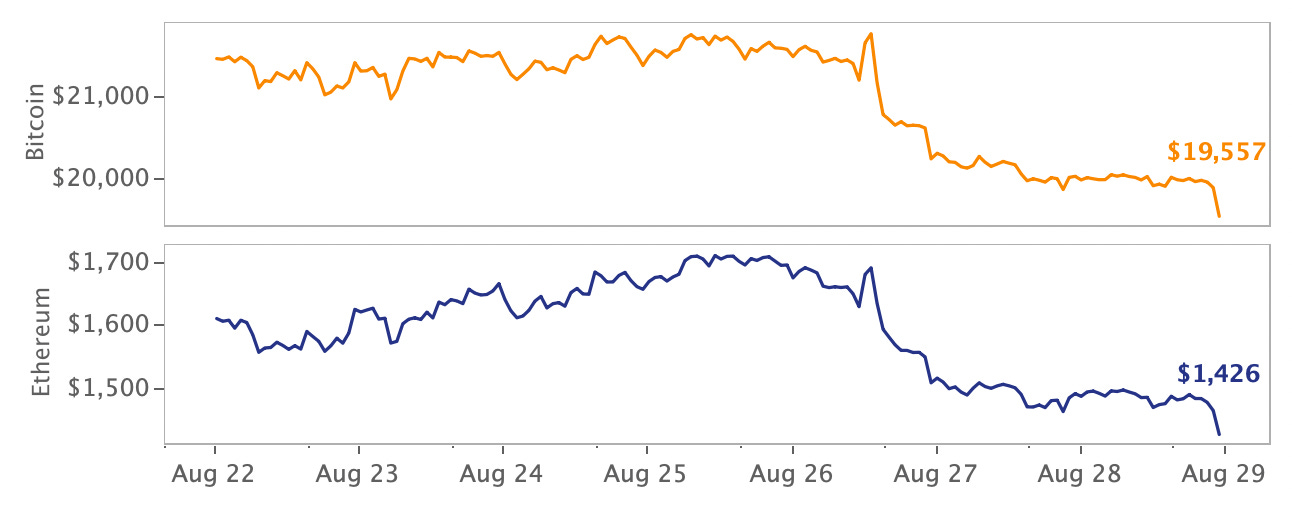

A quick look to the last few weeks price action of BTC-USD and ETH-USD should disclose clearly what I mean.

Worth Highlighting

Ava Labs allegedly participated in class action litigation of competitors

Allegedly, Ava Labs has been instrumental in the filing of several class action lawsuits that sought to steer regulatory attention away from Avalanche while harming competition. Both Ava Labs and Roche Freedman (lawfirm) are currently denying the story, which makes it difficult to verify at the moment. However, the video material displayed does seem to tell a clear story but it will probably be wise to hold a weak stance here until we know more.

Do Kwon delivers the first interview since TerraLuna’s collapse

For the first time since the crash of his empire three months ago, Do Kwon, the founder of Terraform Labs sits for an interview. No material insights gained after watching this here. Kwon plays the innocent victim and we are left to ask if he played by the book or he is putting up an act?Sam Trabucco steps down as CEO for Alameda Research*

One of the dark knights of crypto investing, Sam Trabucco, announced his departure with the CEO-role of Alameda Research. In his stead, Caroline Ellison will take over as sole CEO.USDT / Tether continues its path towards greater transparency

After having faced heavy scrutiny for its lack of transparency in the past, Tether has yet again taken a solid step towards increasing transparency to its holdings and has assigned BDO Italy to perform monthly audits of the reserves.

Venture Capitalists Piling Up Cash

More than a few notable venture funds have recently seen the light of day and seemingly the cash-piling seems to meet no end as new ones enters the scene.

Below you find a list of the most noteworthy venture fund news seen recently.