The Upward Momentum May Not Live Forever

Are we at the start of a secular bull market for crypto or is it a fade?

The financial markets have seen a noteworthy rise over the last few weeks. The question on everyone's mind is whether this is a start of a secular bull market for crypto or if it remains a glimpse of the sun before more rainfall.

Personally, I stay firm in what I’ve stated many times over: Everything is currently a macro trade.

The positivity seen lately may have come in wake of inflation numbers slumping lower year-on-year following the latest CPI measurements. And while that is of course positive, macroeconomists have formed into two camps of beliefs.

One group is becoming more and more certain that because inflation measurements are becoming better, the Federal Reserve will soon be incentivized to loosen the grip on monetary policy and either put the expected rate hikes on a halt or even lower them.

Judging by how the markets have behaved over the last few months, it seems reasonable to believe that a fair amount of market participants are subscribers to this school of thought.

However, if we turn to the other camp of macroeconomists, the opinion is that such positivity may be very short-lived and as Jay Powell, chair of the Federal Reserve, recently stated: combating the high inflation numbers remains the number one priority for the moment.

In other words, the temporary improvement in inflation is not enough to make central bankers turn on their heels, and that a change of policy is not around the corner. If this is a more likely scenario, markets will likely trade sideways in a volatile fashion before any real bull run can materialize for risk assets.

Crypto Lense

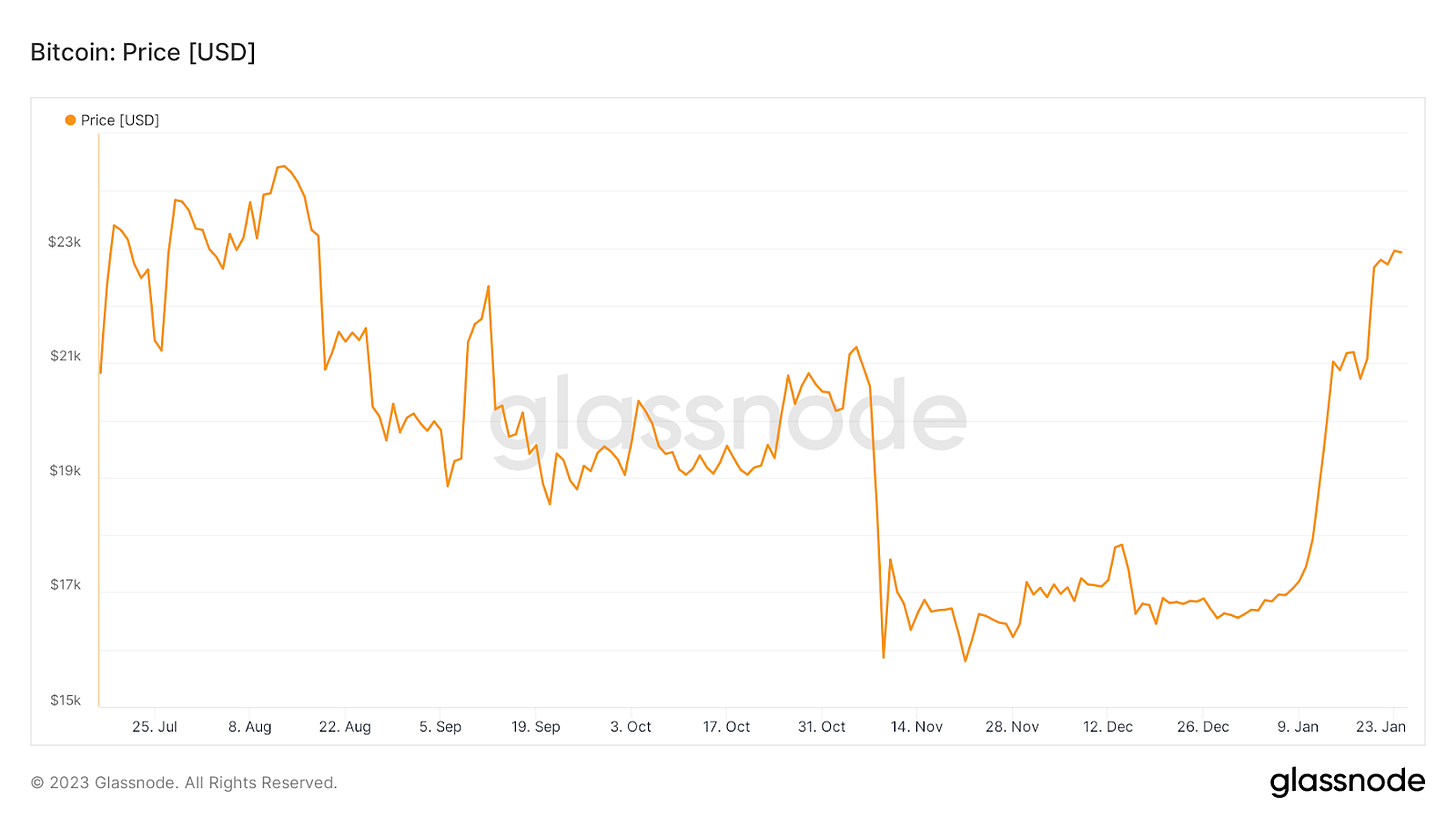

Crypto is currently undergoing its strongest valuation bounce since the start of its bear market in November 2021. Countless technical indicators have turned positive and have likely attracted momentum traders trying to catch part of the action.

Surprisingly enough, the rally has still not had any significant retracement and its characteristics should remind many OG’s about the rally in 2019 that followed the last cycle lows.

Liquidity has likewise flown into other illiquid crypto assets and certain assets such as Lido have benefited spectacularly from the trend.

Upswings like this are likely driven by internal rotations in the crypto markets and are not representative of increased liquidity inflows into the markets. The case for Lido’s latest rally is bounded in its liquid staking derivative offering that fits strongly into current trends where Ethereum network stakers are favoring platforms with lower unstaking times as they await the Shanghai upgrade, which will enable direct unstaking of the ETH locked in the beacon chain.

Notable News

China Launches Smart-Contract Functionality on Digital Yuan

China has taken a major step forward in the development of its Central Bank Digital Currency (CBDC), the Digital Yuan, enabling smart-contract functionality through the e-commerce app Meituan, one of the country's largest food delivery and lifestyle services. China has been a leader in CBDC development among major countries, beginning to test the currency as early as 2020 and using it for retail transactions and securities purchases. Following the remarks made in Davos on the WEF, we are likely to see many more efforts unfold here globally.EU lawmakers strengthening requirements for banks holding crypto

The Economic and Monetary Affairs Committee of the European Parliament has voted to impose stringent regulations on banks that wish to hold cryptocurrency. According to a recently leaked document, the final set of proposed amendments to the 2021 package, which is intended to bring the European Union's bank capital rules in line with international standards, stipulates that banks must treat crypto as a highly risky asset class. This news comes as no surprise, considering the financial difficulties experienced by crypto-focused banks, such as Silvergate, which reported a net loss of $1 billion in the fourth quarter of 2022.Genesis is filing for bankruptcy

In a previous letter, I highlighted that the looming risk of the FTX contagion could wipe out a few more players, specifically DCG or its affiliates. Crypto lender Genesis Trading is the latest casualty of this fiasco, having filed for a chapter 11 bankruptcy on January 19 in the Manhattan Federal Court. Seemingly, the news did not shake the markets too heavily as this was more or less what everyone expected.National Australia Bank creates a stablecoin called AUDN

National Australia Bank has created a new stablecoin called AUDN, which enables business customers to settle transactions using the Australian dollar. AUDN is designed to operate on both the Ethereum network and the Algorand blockchain and will be backed one-to-one with the Australian dollar held by NAB. This stablecoin will be primarily used for settlements between multiple parties. Meanwhile, the country's central bank is working on a central bank digital currency (CBDC) project, with a pilot expected to be completed by mid-2023.HashKey Capital Closes Fund III with US$500 Million in Commitments

HashKey Group's investment division, HashKey Capital, has announced the successful closure of its third fund, with a total of $500 million in committed capital. The fund, titled HashKey FinTech Investment Fund III, will focus on crypto and blockchain initiatives in emerging markets across the globe. This fund was supported by a range of institutional investors, including sovereign-wealth funds, corporations, and family offices. As the bear market marches on and talks of a global recession continue to be on everyone’s lips, it is interesting to see that some entities are still able to raise a lot of capital.