The Train is Not Stopping!

Last week, Nvidia stole the spotlight with its earnings report, significantly surpassing market expectations.

This standout performance spilled over into optimism for the rest of the technology markets, and despite a market wide worry that “things will go down”, valuations continue to rip higher.

Will the markets finally be right about interest rates?

Up until a few weeks ago, the consensus was that the first rate cut of 2024 would happen in March.

This has now changed completely, and there’s now a slim consensus of around 65% that the first rate cut will happen in June.

Bitcoin is Unstoppable

Bitcoin had a great day yesterday being up 5% day-on-day. As per usual, Bitcoin is trading sideways and doing absolutely nothing for some time only to move violently either up or down.

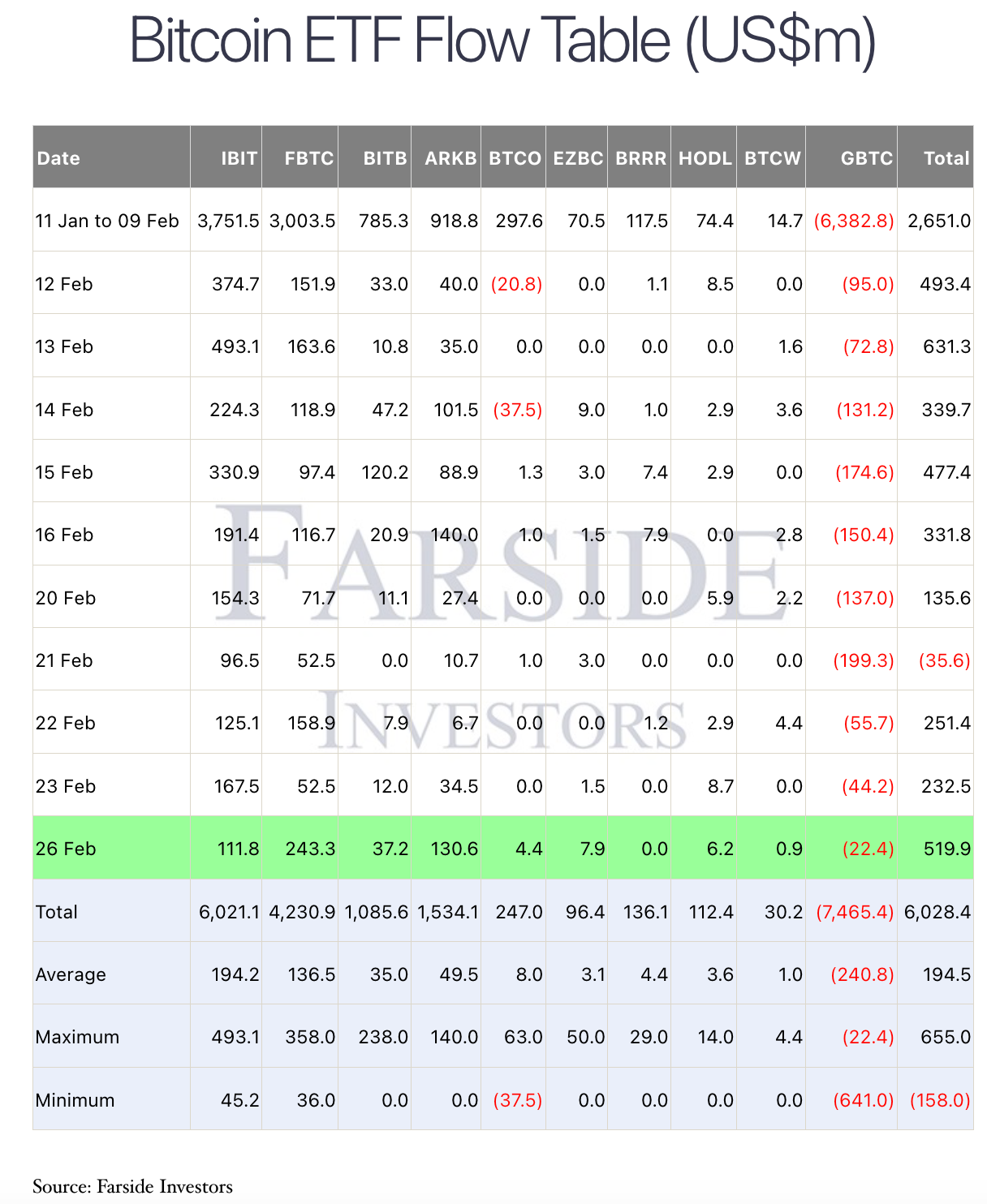

Right now the path of least resistance continues to be upwards, and with more than $500M in reported inflows into the New9 ETFs yesterday alone the daily average inches closer to $200M in net inflows per trading day.

Quite astonishing and to the best of my knowledge the combined ETFs are likely the most succesful ETF launch in history.

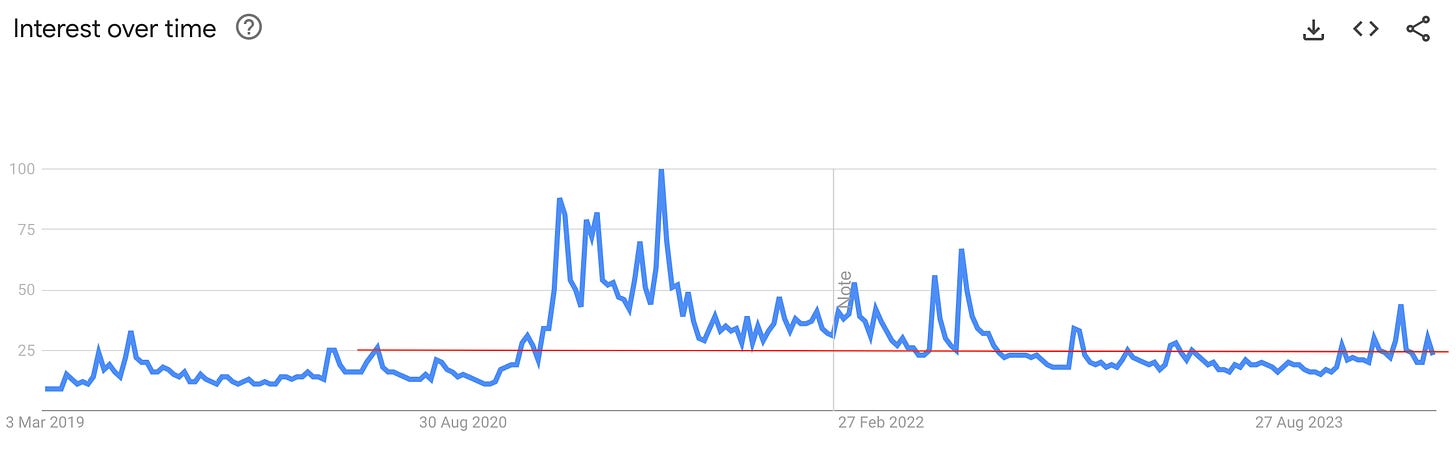

All this is happening at a time when there is limited media coverage on Bitcoin, and where most retail investors are still asleep.

A quick look to Google Trends show that search volume for “Bitcoin” is currently at September, 2020 levels.

This cycle is shaping up to be wild.