Same Procedure as Last Year James

Markets continue to slump sideways and after an initial negative reaction to the 75 basis point rate hike by the Federal Reserve last week. Most markets have already bounced back to levels before the announcement.

Macro experts, who I follow, point to the fact that the FED is nowhere close to loosening up, which should be a cause for concern for anyone dealing in risk assets.

I follow the announcements made by central bankers closely but will rather point to Alfonso Peccatiello distilling the latest FOMC meeting in his letter rather than compile my own opinion here, which would just add to the noise.

Crypto Lense

For last week’s price action, BTC acted rather positively in the wake of the FED tightening the screws again. The positivity for BTC quickly spread to other crypto assets, and many now look ripe for a continued uptrend from a price technical standpoint.

The technical price structure is largely the same for many of the quality crypto assets other than BTC. A few that I have taken a particular liking to lately are: ETH, DOT, and UNI. All of which, apart from being great projects from a fundamental level, have behaved rather positively on the short to medium term price technicals.

Obviously, I am slowly leaning more and more bullish longer into this bear trend we get but I highly recommend to still thread carefully as any material drawdown in the equities markets will likely drag crypto down with it.

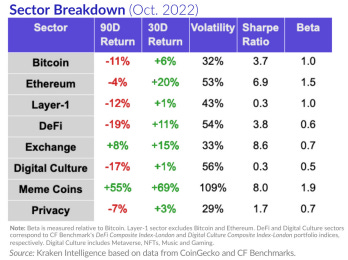

Memecoins outperforming everything else

Looking at the movers in the last month, a few interesting jumps were made among the more obscure crypto assets. DOGE, in particular, exploded upwards in the wake of Elon Musk tweeting a photo of a Shiba Inu (the iconic dog for Dogecoin) wearing a Twitter logo.

Whether Elon Musk, who has previously shown his support for Dogecoin, will bring DOGE and Twitter closer together following his acquisition of the latter is yet to be seen.

However, the strong movements is not to be mistaken of, which dragged up the entire Memecoin sector of crypto for the last month.

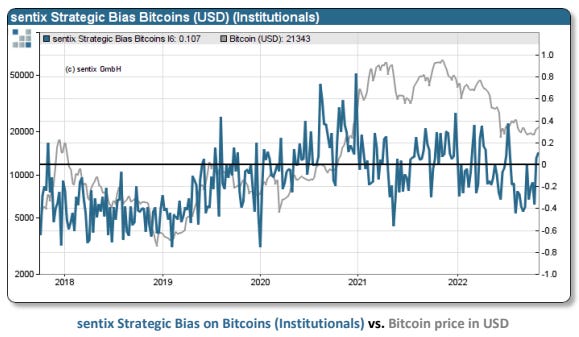

Strategic Sentiment Improving

It seems evident that the sentiment among investors and traders are improving slightly compared to previous weeks. In fact, such strategic improvement in sentiment could be instrumental to a rally continuing further up and not just materialising as being a “bear market bounce”.

Sentiment among investors and traders work as a self reinforcing loop. Positive sentiment creates risk willingness and affects valuations positively, which in turn creates positive sentiment. The question we are left to plunder about is whether this positivity will be short lived due complications for the overall macro outlook.

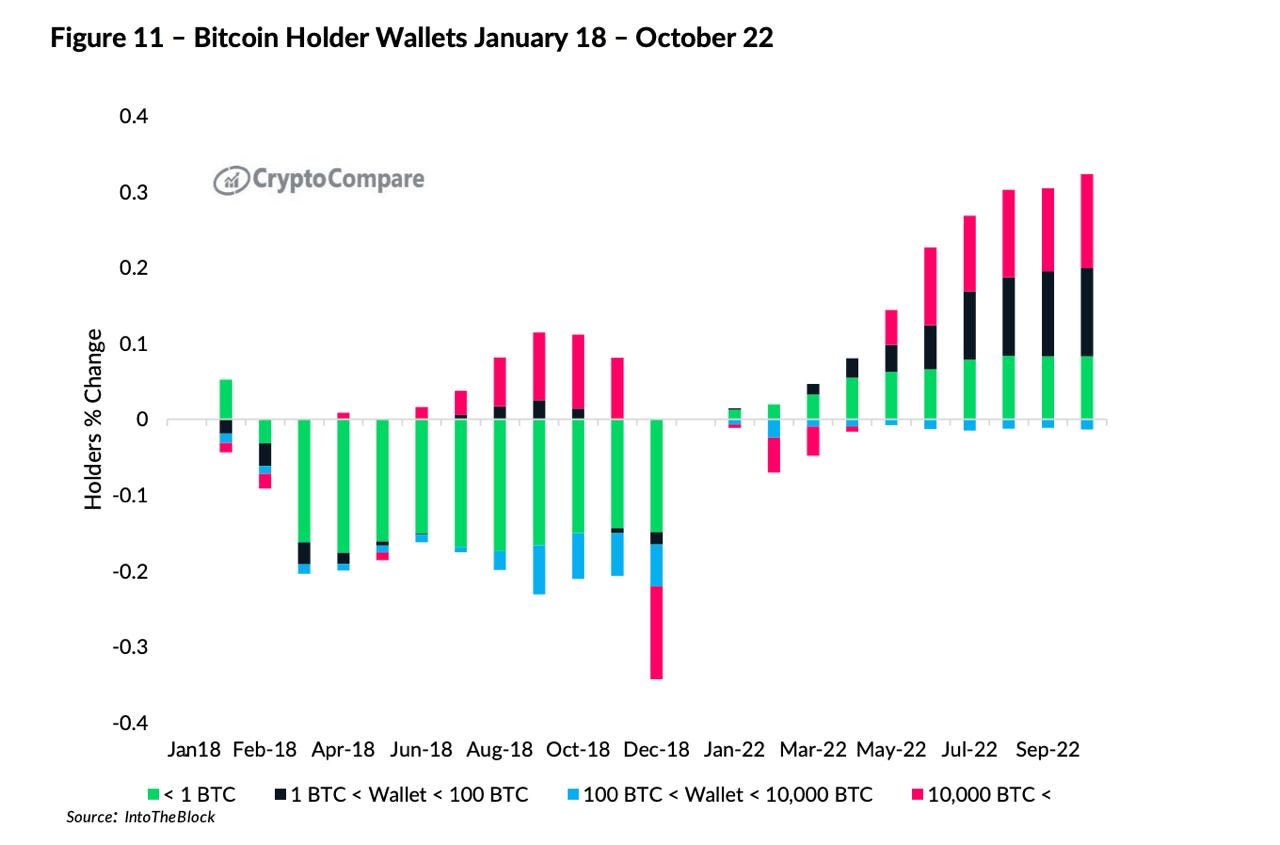

Bitcoin Holders are Sitting Still

In earlier bull markets price depreciation has typically forced long term holders to capitulate at the most dire times of the crypto bear markets. For the current bear market this has been a little different as the only capitulation we saw during this bear was in the beginning of the year.

On the contrary, it seems as though practically all account sizes seems to be accumulating BTC, and have done so for many months already.

Notable Highlights

As part of precautions to safeguard customers from scams, Santander will restrict UK customers from transmitting real-time payments to cryptocurrency exchanges. This comes barely two months after the FCA revealed plans to considerably tighten its rules on cryptocurrency advertising. Other prominent UK banks that do not support crypto assets include HSBC, Lloyds and Nationwide.

The much anticipated Markets in Crypto Assets regulation (MiCA) act is delayed due to ‘technical issues in the text’. According to a spokesperson for the European Parliament, the voting date has been pushed from December, with February 2023 as the earliest possible alternative. This essentially leaves the industry waiting longer for a combined framework, and will result in industry operators to focus on local jurisdictional rulesets.

Uncle Sam is coming for hundreds of crypto tax evaders. IRS Chief of Criminal Investigation Jim Lee said last week that the agency is working on ‘hundreds’ of crypto cases, which will soon be public. This fiscal year, the IRS has seized over $7 billion worth of crypto assets, twice the amount of the previous year’s total. Elsewhere in India, the new crypto tax bill is biting hard on crypto businesses as they struggle to pay 30% capital gains and 1% digital asset transaction tax on all transactions.

Multiple actors started raising questions about the balance sheet of Alameda and FTX. This combined with some lobby efforts made by SBF, led Binance CEO Changpeng Zhao (CZ) lash out in a tweet announcing Binance would sell out of its FTX related holdings. Biggest of such holdings was Binance very large direct exposure to FTT, a native token issued by FTX, which has now brought the whole market down a nudge with it. Very much a shame to see two of the most powerful influences in crypto going toe-to-toe rather than stand united.

Thanks for checking in and remember to share the letter with a friend if you like it. Readership is the currency for me.