Markets Holding Up Amid Geopolitical Tensions

The recent geopolitical tensions stemming from the Hamas attack on Israel triggered a notable downturn in global markets over the weekend.

Nonetheless, despite these persistent high tensions, U.S. stocks have impressively managed to rebound, with the three major indices S&P 500, Dow Jones, and Nasdaq Composite all posting modest gains since the week's outset.

To add to it, September’s Producer Price Index (PPI) reported a 0.5% increase, surpassing the expected 0.3%. Remarkably, the markets appear to have largely shrugged off this increase, with the S&P posting an impressive 2.48% gain over the past five days.

No Crypto Party Just Yet

But while this resilience offers a brief respite for the equities market, it doesn't necessarily indicate that risk-on assets like crypto will rally significantly anytime soon.

The crypto markets continue to chop around with no clear direction while hopeful investors jump to the next big thing only for it to decline again once they start to take profit.

The root cause?

There’s very limited capital inflows to the crypto economy, and as a result, most of the moves are more probable to be internal rotations rather than caused by inflow..

For now, exercising caution for anything crypto remains the course of action I can prescribe. I’m not a big believer that the ongoing geopolitical uncertainty and the contrasting economic data will necessarily provide any big blowbacks to crypto in the near future.

I continue to believe that the cycle bottom has probably been set for BTC and for every week passing without a new low that notion is strengthened.

Bitcoin's Battle to Maintain Support Levels

Bitcoin is currently struggling to hold above the $27,000 level; the price of one BTC is down 3.1% over the past week, currently trading at $26,700.

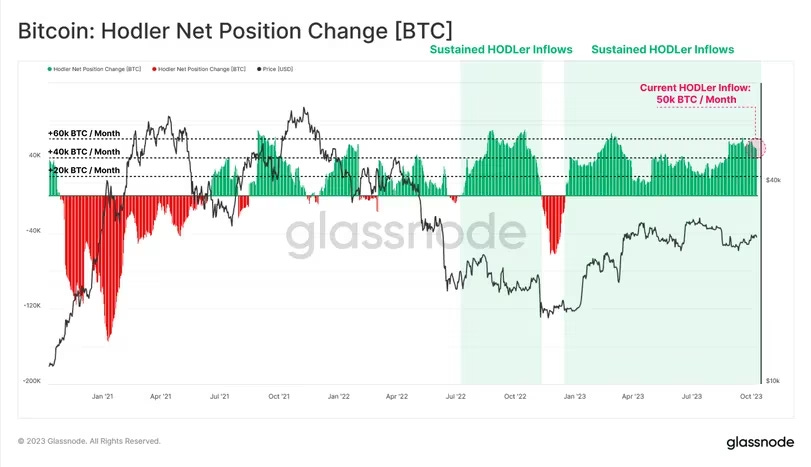

However, amid the reduced market activity, it is interesting to observe is that long-term investors are aggressively stacking sats, with the latest data from Glassnode revealing that HODLers currently hold over 76% of the circulating BTC supply.

Even more intriguing is the rate at which this group of BTC investors is accumulating; 50,000 BTC per month, which translates to around $1.35 billion as per the current prices.

Source: Glassnode

Notably, the increasing interest in stacking BTC is not confined to the crypto community. Hedge fund tycoon Paul Tudor Jones expressed earlier this week that, in light of mounting geopolitical risks and the increasing levels of U.S. government debt, Bitcoin and Gold are emerging as attractive options.

Noteworthy Mentions

Crypto Taxation Landscape: A Global Perspective

Crypto tax policies are dynamic across the world. In our latest article, we highlight some of the advanced crypto tax jurisdictions and tax haven countries’ frameworks. This is a living article that will evolve over time, and the information found is with a high abstraction level. Read full article here.

Industry Shakers

JPMorgan debuts tokenization platform

JPMorgan has officially launched its in-house blockchain-based tokenization app, the Tokenized Collateral Network (TCN), and executed its inaugural trade with asset management giant BlackRock. At the core, TCN allows investors to use assets as collateral by transferring ownership through blockchain, simplifying collateral transactions. It is also worth noting that the tokenization of Real World Assets (RWAs) is currently getting a lot of traction both in crypto and traditional finance.

Zimbabwe turns gold-backed digital token into payment method

The Reserve Bank of Zimbabwe (RBZ) has unveiled Zimbabwe Gold (ZiG), a gold-backed digital payment token. This project was initiated in April 2023, with each digital token being backed by a specific quantity of gold stored in the bank's reserves. The new ZiG token is set to encourage local investors to invest in national assets rather than US dollars, a big hurdle in a country grappling with triple-digit inflation.

FCA issues warning to unregistered crypto firms

The Financial Conduct Authority (FCA) in the United Kingdom issued a warning this week to 146 cryptocurrency companies, enforcing the new promotional regulations mandating registration with the FCA. This move, marking the first warning under the updated rules, is part of the FCA's ongoing efforts to combat illicit financial promotions aimed at UK consumers. Alongside the warning, the FCA published a list of non-compliant entities, including KuCoin and Huobi, among others.