In Fire, Steel is Hardened

The crypto markets are taking a hit again as fears of contagion continue to loom. Yesterday, BlockFi officially filed for bankruptcy (again!) and market participants are waiting in awe of further negative news.

Noone knows how far the dominos from FTX and Alameda Research will fall but in the grand scheme of what is to be expected from a crypto winter this is in a way “business as usual”. However, I will admit this crypto stands out as particularly cold.

In the broader context, the traditional markets remains indecisive and the S&P500 is currently flirting around with the price-top of the diagonal downward trend that started in early 2022.

Whether the index will face “the hammer” yet again is yet to be seen but surely a representation of the muddy macroeconomic picture that is present at moment. I’ve highlighted the bigger themes in previous letters so in order not to beat a dead horse to death I’ll skip that here.

QUARTERLY REPORT COMING OUT JANUARY 2022

If you’re not yet subscribed to the newsletter NOW IS THE TIME because early January we will be publishing a comprehensive report about the crypto markets. The report will only be sent to subscribers!

Crypto Lense

The overall markets are still in a structural downtrend. And even though crypto is taking a hefty beating, they are still not isolated from everything going on in the bigger scheme of things in the “real world”.

And so, “everything continues to be a macro trade” continues to be the mantra as I have been beating the drum on again and again in these letters. The best we can do is to stay cautious about what is going on globally while focusing on crypto.

More specific for the industry, contagion is still an enormous theme. Who will be the next one to bite the grass? With Block-fi filing for bankruptcy yesterday and Genesis and Digital Currency Group (DCG) in heavy distress, markets are extremely worried.

The long term trend and the short term trend are in conflict

In times like this it can be very difficult to keep the bigger perspectives on the industry intact. And because of that, one of the best things we can do is to “zoom out” from current conflicts and try to take a look at the bigger picture for crypto.

For me personally, that exercise always starts with the state of Bitcoin as the godfather of crypto to me (still) persists to be the best barometer of the overall health of the industry. I’ve outlined the three

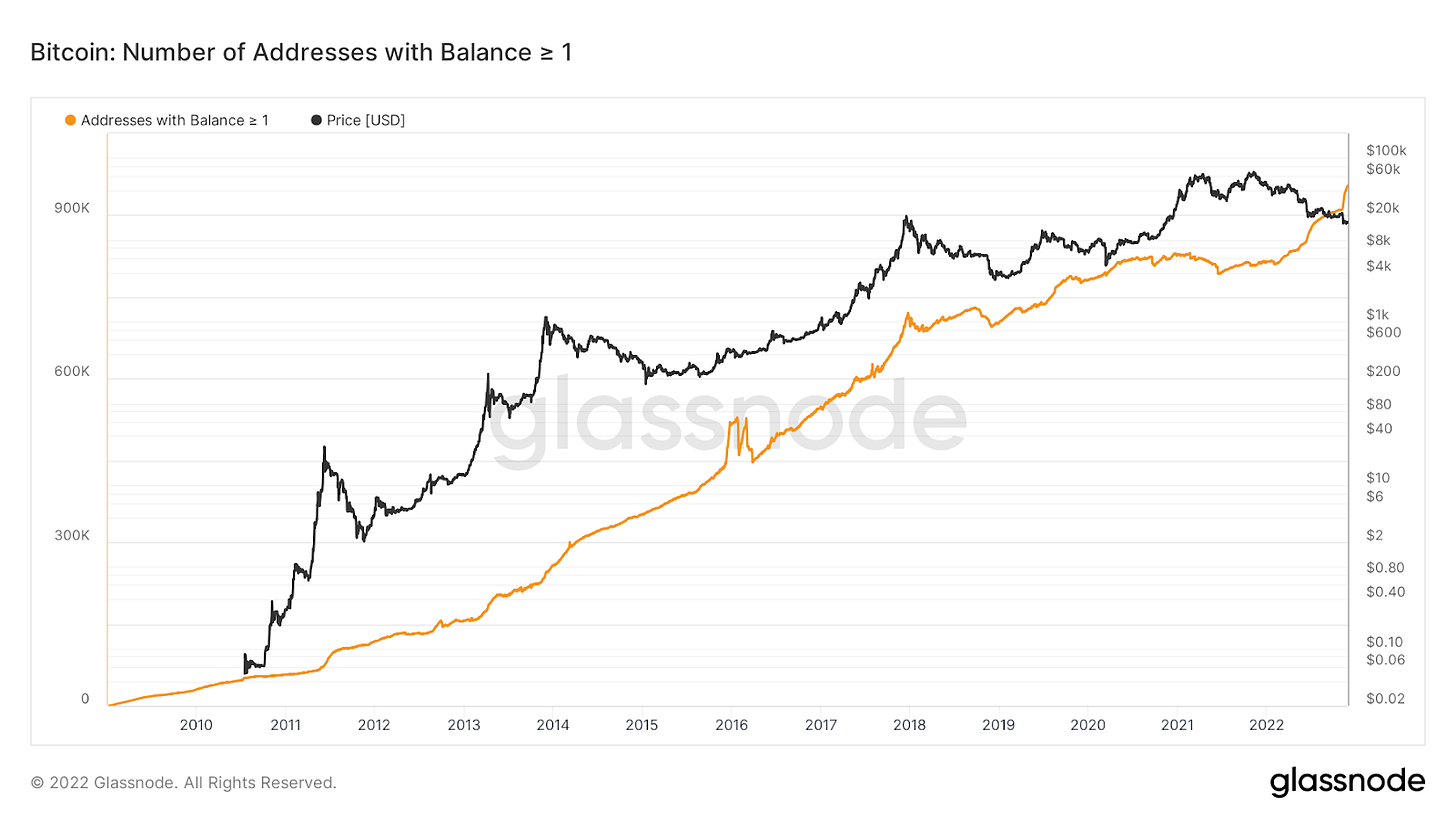

Number of long term bitcoin holders increase

The fundamental value of Bitcoin continues to persist and while short term price movements may suggest otherwise, the argument gets stronger and stronger and time passes.

Market participants are reinforcing this view and analytical data from Glassnode shows that the amount of individual wallets holding 1 BTC or more is at an all time high.

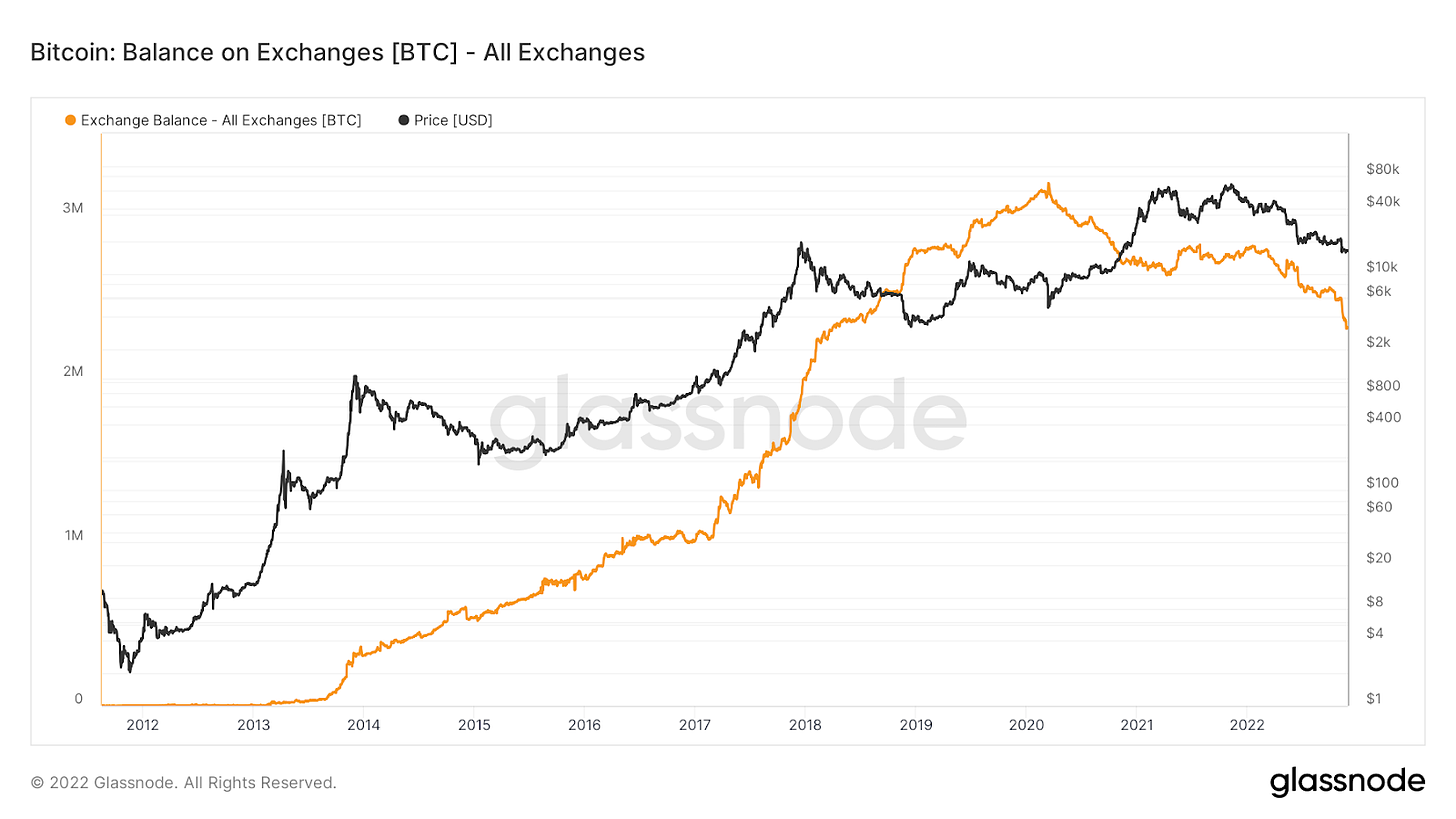

Bitcoin being pulled from exchanges

After the FTX collapse, many crypto investors have been made very aware of the risks associated with holding coins at exchanges. This has sparked a rapid movement where BTC has been withdrawn from exchanges. Very positive for future price development as coins off exchange are more difficult to sell.

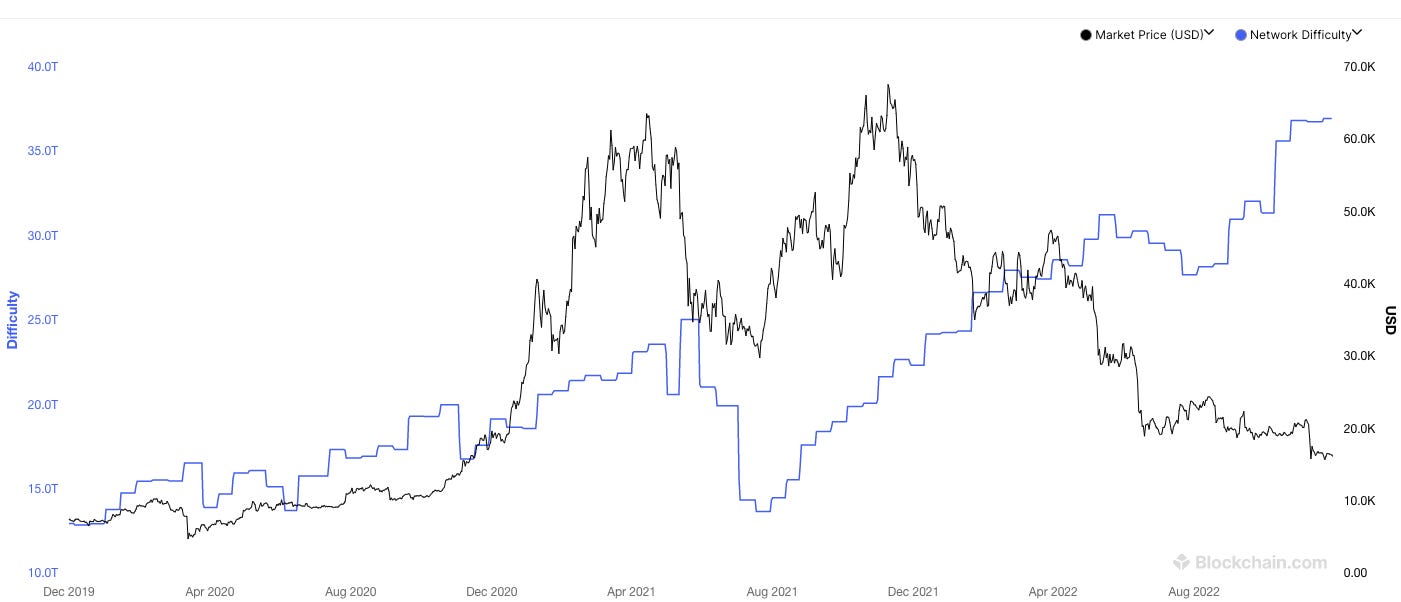

Hashing rate on the Bitcoin network is ever increasing

Despite falling prices, the network difficulty of the Bitcoin network continues to sit stable near its highs. This is positive as it shows the miners willingness to be mining at a potential loss currently due to long term conviction

The counter argument here is that if miners are mining unprofitably for long enough, the weakest entities in the mining industry may be forced to sell out of their current BTC stock or even turn off machines to be able to carry their operation expenses.

In Fire, Steel is Hardened

It’s not the first time the industry has been in distress, and it will likely not be the last. As the industry matures these times of distress is what forces innovation and improvement to happen. An industry which does not have a central bank backed by taxpayers to bail them out, will be forced to reinforce itself against those types of events. Things may look dire but in a way events like this is strengthening the narrative behind decentralisation.

Additionally and to quote CZ, whom I was fortunate to meet at a recent event in Cyprus said: “The technology will not go away”. In the wake of negative cascading catalysts, it is important to remember the fundamental innovation aspects of this industry is providing and how much needed that innovation is for a number of use cases and business models for a better future. In other words, we may suffer now but long term the technology will prevail. We are going to make it!

Notably News:

Next Monday the United States and its allies will be imposing a price cap on Russian oil. This happens as the next step in Biden’s strategy to strengthen U.S. energy security. Allied members are already a bit in disarray as recent discussions show, and the political dilemma between standing united against Russia and sacrificing national political approval seems very relevant for many members.

Binance Establish $2 billion Dollar Industry Recovery Fund

Binance along with Aptos Labs and Jump Crypto are establishing funds to bailout distressed companies in the industry. Probably worthwhile to watch out for the actions of this fund as their bets could see significant recovery in an upcoming bull-market.

Fidelity commences to open crypto retail trading accounts

After initially announcing a waiting list earlier this month, Fidelity Investments has now started opening retail crypto trading accounts. This new offering will allow Fidelity's retail clients to trade Bitcoin and Ether commission-free, potentially increasing crypto adoption given Fidelity's client base of approximately 40 million individual clients.

Putin advocates for blockchain-based international settlement system

President Putin recently criticised the monopoly in global financial payment systems and advocated for an independent, blockchain-based settlement network. This move comes amid a series of targeted sanctions which now appear to be forcing the Russian authorities to consider blockchain technology and digital currency solutions.

ECB President emphasises on ‘MiCA II’ in response to the FTX saga

In the aftermath of the collapse of FTX exchange, Christine Lagarde, president of the ECB, has called regulation and supervision of cryptocurrency an "absolute necessity" for the European Union. We can expect more regulators to toughen their stance on crypto in the coming months in response to the FTX/Alameda bankruptcy.

Crypto Lender Genesis Probed by Regulators

State securities regulators are investigating Genesis Global Capital as part of a wide-ranging inquiry into the interconnectedness of crypto firms. This is not good news for the likelihood of a bail-out of the company, as potential investors will fear fallouts from a dance with regulators.Tension in China as Protests Erupt Over the Zero-Covid Policy

Protests have erupted across China in recent days, as public anger grows over the government's zero-COVID policy, which has resulted in numerous lockdowns and significant restrictions on daily life. Whether these protests could evolve into something bigger is still unclear but global markets slightly tanked on Monday in response to the looming macro uncertainty.