Generative AI Steals the Spotlight in the First Half of 2023

Global markets have remained relatively calm over the past week even as Fed Chair Jerome Powell reiterated a hawkish stance, signaling a possibility of additional rate hikes.

However, as we conclude the end of the first half of 2023, it is interesting to note that the Nasdaq Composite has risen over 30% year-to-date, surpassing the gains of the S&P 500 and Dow Jones Industrial Average, which have surged by 14% and 2% respectively.

This outstanding performance by the Nasdaq can potentially be partly attributed to the hype surrounding generative AI, which has led to significant market value growth for companies involved in this sector including names such as Nvidia, Microsoft, and Alphabet.

Everyone Got Into AI

Evidently, AI has become the new hot topic of Wall Street and Silicon Valley. Whether or not the current hype is 100% justified, it seems obvious that the new era of AI applications is here to stay and likely.

In light of these developments, Blackrock is also betting big on this nascent niche and recently lauded AI-related stocks as potential drivers of returns, particularly amidst the challenging macro conditions.

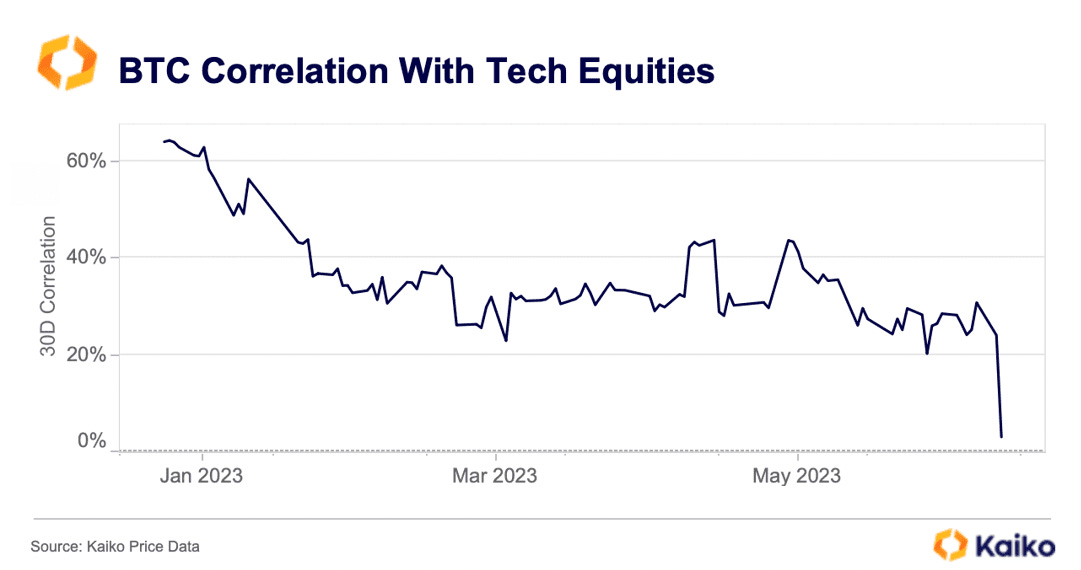

Bitcoin’s Correlation with Tech Stocks Hits 3-Year Low

Bitcoin's correlation with tech stocks in the Nasdaq 100 has reached a three-year low following BTC's impressive performance this month. At the beginning of the year, the correlation stood above 60%, but it plummeted to as low as 3% last week.

Image source: Kaiko

Although BTC's recent rally, fueled by BlackRock, appears to have encountered strong resistance at $31K, the decoupling signifies a potential shift into new territory. However, at the same time, this decoupling does not necessarily imply an imminent rally for BTC.

Staked ETH Surpasses Balance on Centralized Exchanges

According to data from Nansen, the number of staked ETH surpassed the balance held on centralized exchanges on June 26, reaching 23.36 million ETH compared to 23.35 million ETH held on exchanges, including industry leaders Coinbase and Binance.

The staked figure represents 19.4% of the total ETH in circulation, marking a significant increase from the 15.6% during the time of the Shanghai upgrade.

While this increase can be attributed to the improved ease of staking and withdrawal following the upgrade, the recent regulatory crackdown on centralized exchanges has also played a role.

More and more crypto enthusiasts are opting for self-custody solutions.

Noteworthy Mentions

A Deep Dive Into Crypto Banking

Historically, banking has always been a hard topic for crypto companies to tackle, and with the collapse of crypto-oriented firms and banks earlier in the year, that issue is re-iterated. US regulators are warning banks about the risks of serving the crypto industry, leading to reluctance among traditional banks. Luckily alternative solutions are on the rise. Read the article in full here.

Industry Shakers

JPMorgan deploys JPM Coin for euro-denominated payments

JPMorgan has successfully implemented its blockchain-powered payment system, JPM Coin, to facilitate euro-denominated payments for its corporate clientele. Basak Toprak, the head of coin systems for Europe, the Middle East, and Africa at JPMorgan, confirmed that the platform began conducting euro transactions on June 21. Notably, German conglomerate Siemens became the first entity to execute a euro payment through this system.

GBTC’s discount to NAV narrows as Bitcoin race ETF kicks off

Following a wave of new filings for spot bitcoin exchange-traded funds (ETFs), Grayscale's leading Bitcoin Trust has experienced a reduction in its discount to net asset value (NAV). On June 23, GBTC was trading at a 31.32% discount to NAV, marking a decrease from the 44.02% discount observed on June 13. The recent entry of BlackRock into the competition for spot bitcoin ETF and HSBC Hong Kong support for BTC and ETH ETFs has injected renewed optimism, increasing the possibility of an eventual approval for an ETF in the US as well.

Microstrategy adds to its Bitcoin stash with a $347 Million BTC Purchase

MicroStrategy (MSTR) revealed on Wednesday that it has acquired 12,333 bitcoin (BTC) for a cash amount of $347 million. The purchase was made between April 29 and June 27. With this new BTC acquisition, MicroStrategy's Bitcoin holdings now total 152,333 BTC, which is valued at over $4.6 billion based on current market prices. The company is currently one of the largest holders (HODLers) of Bitcoin.