Crypto Regulator’s are Tightening the Belt

The crypto industry are being subject to an array of regulatory probes while valuations are on the rise.

Financial markets took a slight dive slide downwards earlier in the week in the wake of inflation numbers coming in a bit hotter than expected. This a reaction, that seems a bit exaggerated given inflation numbers actually came in lower than those of last month (6.4% this month vs. 6.5% last month).

In other words; things are going in the right direction but perhaps not as quickly as we are all hoping for.

The disappointment also sent BTC down on the day of the news but has since recovered nicely and even broke out to the upside trading just above 24.000 USD as of now.

Crypto Lens: Regulation, regulation, regulation!

The crypto ecosystem is currently facing mounting pressure from regulatory authorities in what the industry has labeled as Operation Choke Point 2.0.

Although the titling of the said article may be a bit too harsh, recent moves by authorities in the US definitely seem like a coordinated effort to clamp down on crypto as an industry.

The Securities and Exchange Commissioner Gary Gensler is the one leading the battle.

First, it was Kraken’s $30 million settlement for offering its crypto asset staking-as-a-service program. Then it was the BUSD stablecoin offered by Paxos, which is currently being scrutinized for being a security, and now the whole industry is sitting tight waiting for the next bomb to be fired.

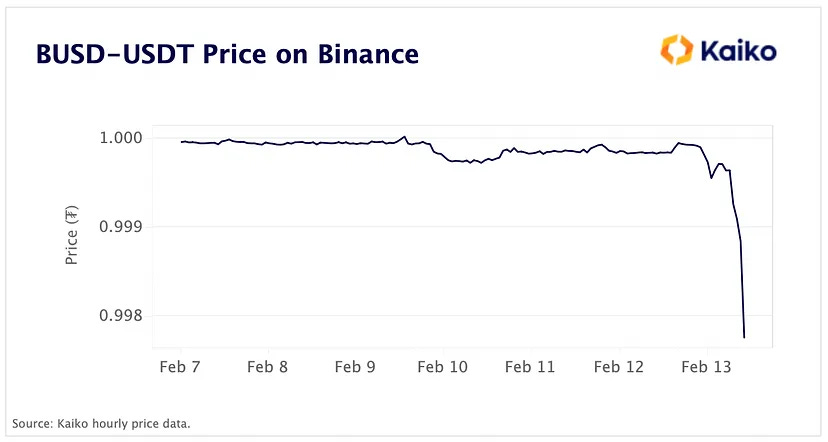

BUSD slightly de-pegged from the US dollar following this news, although CZ Binance confirmed through a tweet that funds are fully backed and redeemable.

A turn to the brighter side, regulatory pressure on crypto is part of forging the resilience of this industry, increasing decentralization and jurisdictional dependency.

Worthy Highlights

Partnership with D-Core

We recently partnered with D-Core, one of the leading institutional-grade crypto research firms, and we will soon be releasing a collaborative report together with them directly on their website. Stay tuned!

Top 5 Narratives of 2023

In a featured article on investing.com, we have written a piece about what we believe are the most important narratives of 2023. Not surprisingly this includes DeFi, Game-Fi, Layer1’s, and the NFT space.Ulrik Lykke featured on a Børsen.dk on Layer1-protocol Concordium

Concordium is a compliant privacy layer1 protocol that launched back in 2021. Ulrik Lykke delivered a commentary on its native token price development.

Industry Shakers

Global Crypto Industry Pledges Aid to Turkey

After two powerful earthquakes and multiple aftershocks caused destruction and claimed thousands of lives in Turkey and Syria last week, local and foreign crypto exchanges have pledged aid. Ethereum co-founder Vitalik Buterin has made substantial contributions of $227K to assist the victims of this devastating earthquake, and many other organizations and countries are offering support as rescue efforts are still underway. So far, the earthquakes have caused at least 33,000 deaths.

UAE Plans to Issue a CBDC to Promote Digital Payments

The UAE Central Bank has announced a new Financial Infrastructure Transformation Program, which includes the issuance of a digital form of the UAE's dirham for domestic and cross-border payments. This comes as part of a wider trend of central banks considering the use of Central Bank Digital Currencies (CBDCs) to improve their payments and banking infrastructure, such as the Bank of England's recently published plans for a digital pound.

Genesis Unveils Proposed Sale Plan With DCG

Genesis Global Holdco has released the last specifics of a plan to sell itself and Genesis Global Trading in order to help Digital Currency Group (DCG) pay off some of its creditors. According to a bankruptcy court filing, DCG will give up its stake in Genesis Global Trading to Genesis Global Holdco, as part of the effort to restructure its loan and sell both companies. One of the milestones of this sale process is the agreement to "equitize" Genesis' assets, among Genesis, GGC creditors, the Ad Hoc Group Advisors, and DCG.