Crypto Macro Uncertainty as Liquidity Dries Up

I’m slowly getting tired of writing about the Fed's aggressive rate hike that has been rambling on since March 2022. The fact of the matter is that we are slowly but surely inching closer to the target 2%. Right now, realtime data from Truflation shows a current inflation rate 2.59%.

This should warrant that a shift in monetary policy could be around the corner. However, latest data from the CME FedWatch Tool is pricing a probability of over 40% for another rate hike in November.

China’s not helping

There’s more than a few things happening in China to look out for. First, China fell short of growth estimates for Q2 of 2023 which in itself would not be so concerning were it not for the fact that its real estate market is showing severe signs of weakness.

At the same time, China seems to be actively selling its US Treasury holdings, which are now sitting at a 14-year low of $835 billion.

Crypto Market Apathy: Where’s the Liquidity?

Grayscale’s win against the SEC brought some positivity to the markets but was rather short lived. The larger crypto market gains from last week have already been erased, with BTC dropping by over 5%.

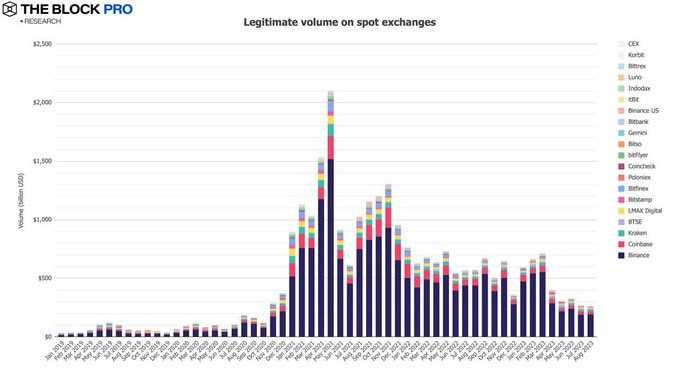

One of the most important things to take note of right now is the fact that liquidity in the markets has completely dried up. Both BTC’s and ETH’s adjusted volumes on spot exchanges is sitting at the lowest level seen since October 2020.

Source: The Block Pro

Time of Apathy - Time to Buy?

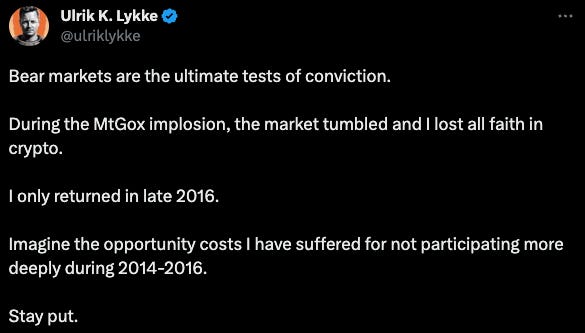

The market is currently trading in what can be seen as a state of apathy. The emotional sentiment swings are becoming less and less and it seems as if investor interest in the crypto markets as a whole is dissipating.

The good news is that this seemingly is not enough to push prices lower at the time of writing. This could change if a negative catalyst emerges but if that is not the case this could arguably be one of the best times to buy.

It is difficult to tell if the markets will move higher in the short to medium term as there is also a complete lack of bullish narrative playing out. This could change dramatically if positive news about the Bitcoin Spot ETF comes out. With the recent win of Grayscale over the SEC it seems obvious that it is a question of when and not a question of if, and with the halvening event of Bitcoin slowly approaching there’s a good chance for the markets to rise over the medium to long term time horizon.

Noteworthy Mentions

An Introduction to Decentralised Autonomous Organizations (DAOs)

The intersection between blockchain technology and corporate governance is setting the stage for a new era in strategic decision-making. In our latest research piece, we introduce the concept of DAOs, a possible solution to the agency problem that has long faced corporations. For more insights, here is the full link to the article.

Industry Shakers

MetaMask launches feature to sell ETH for fiat

MetaMask recently unveiled a feature that enables users to exchange Ether for traditional money. Those who have their crypto wallets linked to MetaMask's Portfolio decentralised app can now convert their ETH and transfer the equivalent in fiat directly to banks in the US, UK, and certain European regions. While currently restricted to ETH, MetaMask intends to broaden this feature to incorporate "primary gas tokens on secondary layer networks" down the line.

Travel Rule regulation comes into force in the UK

The Financial Conduct Authority in the UK has initiated the application of the Travel Rule. This compels Virtual Asset Service Providers (VASPs) operating in the UK to gather, confirm, and circulate data regarding both local and cross-border transactions. Cryptocurrency firms in the UK will be required to collect details in compliance with anti-money laundering directives from entities in areas not governed by the Travel Rule.

Visa Taps Solana and USDC Stablecoin

Visa, the worldwide payment processing giant, has introduced support for USD Coin transactions settled through the Solana blockchain, broadening its stablecoin services. Visa disclosed that it's actively conducting real-time pilot projects with issuers and acquirers, transferring vast sums of USDC between associates on both Ethereum and Solana blockchains to finalize payments in traditional currency.