Continuation of the Looming Banking Crisis and Default Risk

The US Federal Reserve raised rates by 0.25% last week, increasing its benchmark rate to between 5% and 5.25%: the highest since 2007.

Although most investors expect that this latest hike will be the last, Fed Chair Jerome Powell has left the door open for another possible hike in June, subject to incoming data.

The news of the rate hike caused US regional bank shares to plummet, reigniting concerns of a banking crisis, particularly following JP Morgan's acquisition of First Republic Bank (FRC), which had earlier been seized by US regulators.

Despite this development, US authorities have assured the public that the banking system remains sound and resilient.

However, their assurance may soon face a challenging test as Treasury Secretary Janet Yellen recently warned of the US government potentially running out of cash to pay its bills by June 1st.

While the US Congress is expected to vote on raising the debt ceiling before then, partisan politics are causing delays in the process.

Assuming that the debt ceiling is raised - which is the more likely scenario - there is a high probability that a significant amount of capital will be drawn out of the already struggling market in favor of top-rated US government debt.

Bitcoin’s Daily Transactions Record New High

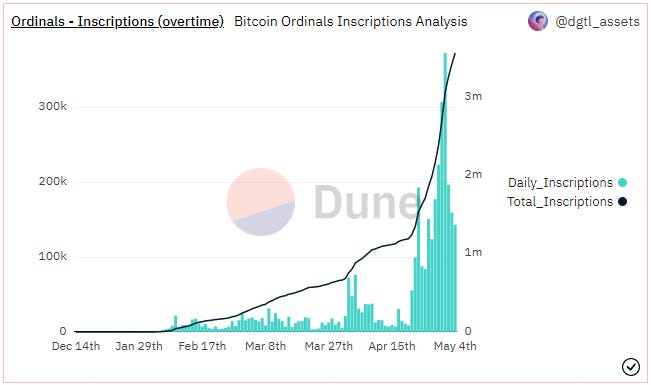

In the crypto market, Bitcoin set a new all-time high record in daily transactions, thanks to the growing popularity of ordinals.

As per data provided by a frequently used Dune dashboard, a significant 307,000 out of the 568,300 total transactions recorded on April 30 were Ordinal inscriptions.

Clearly, there is a lot of interest in the potential of digital artifacts, and this time the Bitcoin blockchain is not being left behind.

As for the price action, last week was quite volatile, BTC pumped slightly towards the $30K following signals of distress in the banking sector and positive tech earnings reports but has since retraced to currently trade around $27.000

PEPE Meme Coin Hype

PEPE meme-coin, dubbed "the most memeable memecoin in existence," has achieved a remarkable feat since its launch in April.

The hype around PEPE has fueled its rapid price increase of over 2,100%, making it one of the most researched coins on Nansen and Coingecko.

Such rallies have in the past been an indicator of an exuberant sentiment among market participants but this time around, I speculate it is rather a signal of traders getting bored with the sideways price action.

Noteworthy Mentions

Bitcoin: The Antidote to Global Uncertainty

We are excited to finally share this special piece about ‘Bitcoin: The Antidote to Global Uncertain’ that we've been working on for the past two months. Bitcoin is always one of the most difficult subjects to write about and this piece was also not easy to manage. If you’re ever going to read any of our research, this should be the one! Link

Industry Shakers

Binance Withdraws from Voyager deal

Binance.US has announced its withdrawal from a deal to buy Voyager Digital assets worth USD 1 billion, despite an acquisition agreement reached between Voyager, its Official Committee of Unsecured Creditors, and the US government on April 19, 2023. Binance.US cited the uncertain and unfriendly regulatory environment in the US as the reason for its decision to terminate the asset purchase agreement.

Biden administration wants a 30% tax on Bitcoin miners

The Biden administration is proposing a new tax called the Digital Asset Mining Energy (DAME) excise tax, which would impose a 30 percent tax on the electricity used for cryptocurrency mining. The administration argues that crypto-mining companies do not cover the full costs they impose on others, such as environmental pollution and high energy prices.

Nigeria's SEC Mulls Allowing Tokenized Equity and Property

According to Bloomberg, Nigeria's Securities and Exchange Commission is contemplating permitting equity, debt, or property-backed tokenized coin offerings on licensed digital asset exchanges. The regulator is also reviewing applications for digital exchanges on a trial basis, subjecting them to a year of "regulatory incubation" with restricted services and SEC oversight to assess the firms' suitability for providing services.