China is Shaking While Bitcoin Continues to Gain Institutional Ground

China's economic challenges intensified at the beginning of this week, with the CSI 1000 index experiencing a decline of over 15% in the past five days.

As highlighted in one of my recent letters, China's economy has been grappling with headwinds, which appear to have been exacerbated further last week when a Hong Kong court judge ordered the liquidation of the indebted real estate giant, Evergrande.

Despite the Chinese authorities implementing various fiscal measures to stimulate it seems at current terms that there’s still broader indicators of pain in the Chinese economy.

What I’m paying attention to in regards to this is how the authorities will respond.

In the most recent intervention following Monday’s downturn, authorities have taken steps to implement more extensive trading restrictions:

Nearly 30% of all stocks in China have been halted

Limiting investors' ability to short Hong Kong stocks

Some investors limited from selling their positions

Some quant funds are completely banned from placing sell orders

Other quants funds banned from cutting leveraged positions

It remains uncertain whether these new measures will avert the ‘looming’ crisis, or if China’s PBoC will be forced to adopt looser economic policies.

With the Fed still also yet to stop tightening measures the conundrum is: Who will blink first, China or the US?

Bitcoin Enters Accumulation Phase Post ETF

BTC’s price has been range bound over the past week, trading between $42K and $43.5K as the excitement around the spot ETF approvals continued to cool down.

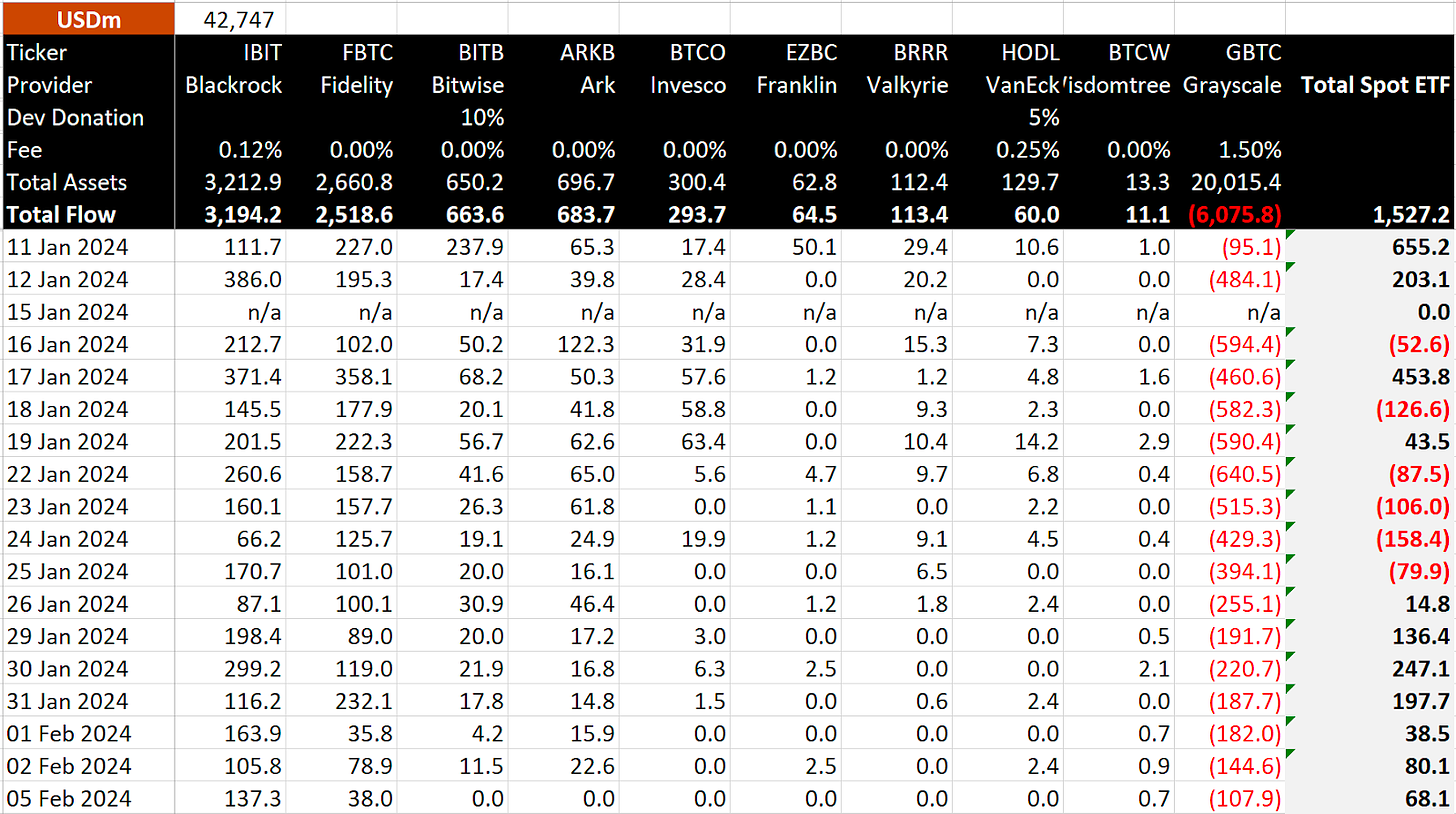

However, it's noteworthy that net daily inflows have remained positive for the last seven consecutive trading days, with BlackRock and Fidelity taking the lead.

Bitcoin ETFs in Top10 for January

Fidelity and BlackRock’s ETFs secured positions in the top 10 ETFs measured by inflows during January. BlackRock’s iShares Bitcoin Trust (IBIT) claimed the eighth spot with an estimated $2.6 billion in net flows, while Fidelity Wise Origin Bitcoin ETF (FBTC) secured the tenth place with $2.2 billion in net flows.

Not too shabby for ETFs that launched less than a month ago!

The Supply Shock Will Come…

While it is still too early to predict precisely when the institutional adoption of BTC will have a significant and long-term positive impact on the price, industry experts — the latest being ARK Invest — seem to agree that Bitcoin might be finally ripe for institutional adoption.

Here’s why:

Bitcoin has outperformed every major asset over longer term horizons

Bitcoin’s correlation with traditional assets is low (0.27 over the past five years)

Bitcoin could play a major role in maximising risk-adjusted returns

Source: ARK Invest

Industry Shakers

El Salvador's Bitcoin-Friendly President Nayib Bukele Wins Re-Election

Nayib Bukele, the president of El Salvador known for his support of Bitcoin, appears poised for another five-year term, as indicated by exit polls revealing his substantial lead shortly after the conclusion of Sunday evening's voting. Initial results on Monday morning showed Bukele securing 83% support, based on just over 70% of the ballots counted. While the official results are yet to be announced, Bukele has declared victory, asserting that he garnered more than 85% of the vote.

Genesis Seeks Approval to Sell Nearly $1.4 Billion GBTC Shares

Genesis, the now defunct crypto lending company, is seeking authorization to liquidate $1.4 billion in shares from the Grayscale Bitcoin Trust (GBTC), Grayscale Ethereum Trust (ETHE), and Grayscale Ethereum Classic Trust (ETCG). Originally used as collateral for a loan from Gemini, these shares became subject to foreclosure due to Genesis defaulting on its financial commitments. The legal ownership of these shares is still under dispute in court.

Binance Code, Internal Passwords Leaked on GitHub

A repository on GitHub publicly exposed a collection of sensitive information related to Binance, comprising code, passwords, and infrastructure diagrams. This data had been accessible for months before Binance identified it and requested a takedown to remove the information. Binance, however, emphasised that the exposed data “posed negligible risk to the security of our users, their assets or our platform.”