Bitcoin Shrugs Off Market Uncertainty

Global markets are still facing headwinds with the latest Fed minutes revealing that the decision to pause the 10-month consecutive rate hike was vigorously debated.

Following the hawkish sentiment of the Fed, interest rate futures have risen significantly this week now pricing in a 94% chance of a 25 bps rate hike in July, and a 10% chance of three more hikes this year.

Job Markets are Still Hot

While debates of a recession are still debated, the latest US job report disclosed 497,000 new jobs in the private sector - More than double what was anticipated by Dow Jones analysts.

Interestingly, the stock market has managed to perform well despite the uncertainty. The S&P 500 and Nasdaq have both recorded extremely positive gains year-to-date, with the former up 14% and the latter impressively gaining 30.8%.

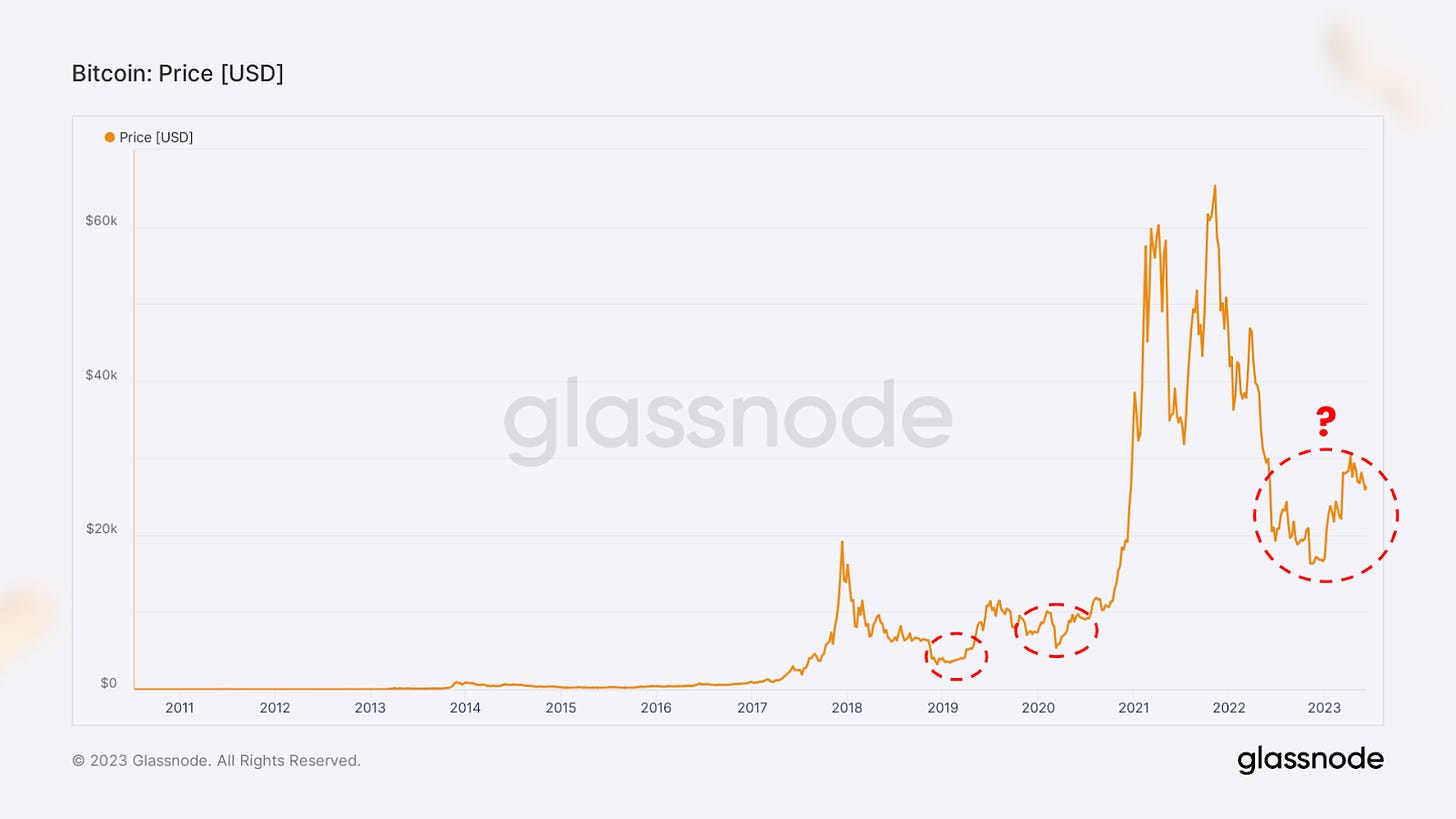

Bitcoin Ripe for Another Bull Run?

Bitcoin, the pace-setter of the digital asset market, is displaying considerable strength and signaling that the range between $29.5K to $31.5K could serve as another accumulation zone before the next leg up.

Moreover, there are several trends that are particularly intriguing to observe, as they have historically indicated the start of a bull market. These include:

Bitcoin's correlation with US stocks continues to decrease.

BTC’s increased market dominance compared to other digital assets.

Computational power on the Bitcoin network continues to rise.

Long-term HODL’ers continue to accumulate BTC with the highest number of wallets containing 0.1 and 1 BTC ever recorded.

Continued commitments from major institutional players continue to surface (Blackrock ETF filing among others)

Industry Shakers

Valkyrie Refiles for Spot Bitcoin ETF With Coinbase as Surveillance Partner

Valkyrie Digital Assets has resubmitted its application for a spot bitcoin exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission (SEC), joining the ranks of asset managers like BlackRock and Fidelity. In their recent 19b-4 paper, the Tennessee-based asset manager disclosed that they have partnered with crypto exchange Coinbase for a surveillance-sharing agreement.

South Korea's National Assembly Passes Virtual Asset User Protection Act

South Korea's National Assembly successfully passed the Virtual Asset User Protection Act, signaling the country's initial move towards establishing a comprehensive legal framework for virtual assets. The act mandates that service providers segregate user assets, obtain insurance coverage, maintain reserves in cold wallets, and keep records of all transactions.

Kraken Ordered to Hand Over User Information to IRS

In a recent ruling, the U.S. District Court of Northern California has determined that Kraken, a prominent cryptocurrency exchange, is obligated to furnish the IRS with substantial user data. This includes details such as names, addresses, and transactional records, specifically for users who engaged in cryptocurrency trades worth a minimum of $20,000 between 2016 and 2020.

Credit Suisse issues Ethereum NFTs to raise funds for women’s football

In a collaboration between Credit Suisse and the Swiss Football Association, the two have launched an initiative to issue non-fungible tokens (NFTs) on the Ethereum blockchain in support of the women's team. This collection of 756 NFTs will feature digital artistic representations of Swiss women's national football players. The proceeds generated from the sales of these NFTs will be directed towards the Swiss Women's National Team and selected youth initiatives that prioritize girls' football.