Bitcoin Lifts Off as U.S. Economy Cools Down!

Following the Fed’s decision last week to leave the fund rate unchanged (5.25% - 5.5%), the 10-year Treasury yield has cooled down to slightly above 4.6%.

At this point “no news is good news” for monetary policy, and there’s even a chance that we will not see further rate hikes past this point.

That notion is supported by the slow down in the job market. Only 150,000 jobs added in October in the U.S against the Dow Jones estimate of 170,000.

What is almost certain is that 'higher for longer' rates are the new norm; the CME FedWatch tool predicts that the closest the Fed is likely to lower interest rates is in May 2024.

As we approach the end of 2023, market participants are weighing whether to double down on riskier assets or wait for more signals from the Fed before making any long-term portfolio decisions.

Bitcoin Rallies Past $37K; The Best Performing Asset of 2023?

Bitcoin's price is up over 6% within the past week, and as previously mentioned in one of my recent letters, there are several factors that indicate BTC could be undertaking a new secular bull market.

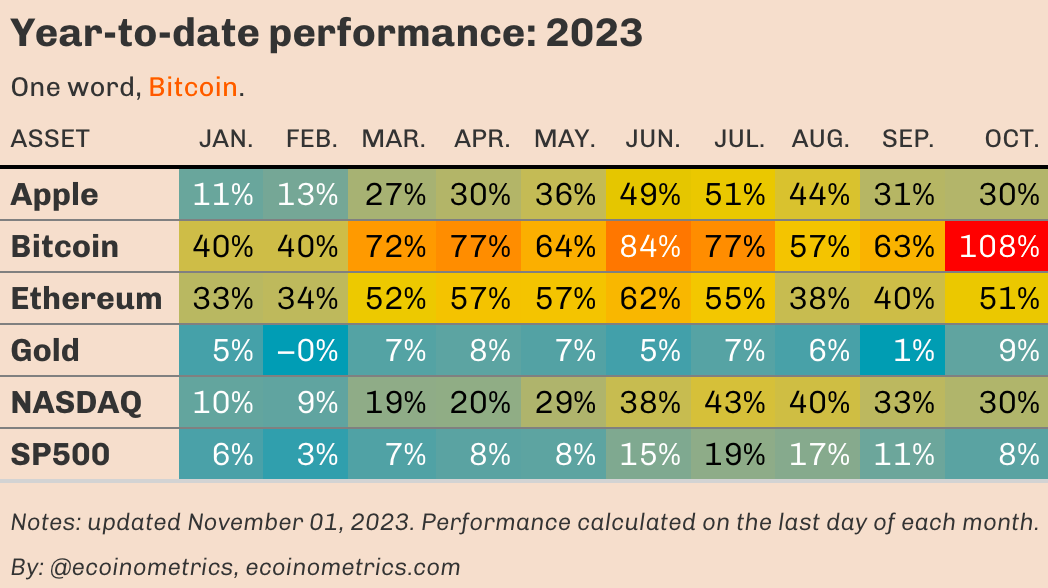

Bitcoin’s performance this year gets even more impressive when compared to other markets being the fastest horse in the race by a great mile.

Source: Ecoinometrics

The Chickens are Home to Roost

As the BTC bulls celebrate, the same cannot be said for a few of the now disgraced crypto founders most notably FTX founder Sam Bankman-Fried.

The jury found him guilty of all seven counts of fraud and conspiracy brought forward against him. SBF now faces up to 110 years in prison, with the sentencing scheduled for March 28, 2024.

Do Kwon, who was earlier in the year sentenced to 4 months in prison in Montenegro, could also soon be facing the wrath of the SEC, which is currently seeking a summary judgement against Terraform Labs and Do Kwon himself.

Su Zhu, Three Arrows Capital co-founder, is also in the custody of Singapore authorities following his arrest in September.

Noteworthy Mentions

Crypto Market Snapshot Q3 Moving Into Q4

In our latest in-depth analysis, we took a deep dive into the performance of the crypto market in Q3 and moving into Q4. There were some interesting trends, most notably Bitcoin's resilience and surge at the onset of Q4. For more detailed insights on how other crypto sectors performed, here is the full link to the article.

Industry shakers

UK Financial Watchdogs Publish Plans to Regulate Stablecoins

The UK's Financial Conduct Authority (FCA) has mandated that fiat-backed stablecoins used in the country must adhere to uniform standards, regardless of the issuer's location. The FCA's recently released 109-page discussion paper outlines its approach to stablecoins, including potential benefits like faster, cheaper, and frictionless payments between consumers and merchants.

Hong Kong Now Considering Spot Crypto ETFs for Retail Investors

The Securities and Futures Commission (SFC), Hong Kong's securities regulator, is leaning towards enabling retail investors to purchase spot crypto Exchange Traded Funds (ETFs). This development follows recent updates to financial regulations in the city, allowing retail investors to access spot crypto ETFs. Hong Kong regulators have been adopting a progressive stance on cryptocurrencies, with a noticeable shift in their perspective on retail exposure to digital assets over the course of 2023.

HSBC Launches Tokenization Platform for Gold Markets

HSBC bank has introduced a gold tokenization platform aimed at streamlining gold trading, providing traders with enhanced control over their bullion holdings. Through tokenization, the gold bars on the platform will be digitized, enabling owners to track their bullion by serial number and vault location. This approach aims to make the process of locating these bars "quicker and less cumbersome."