2023 Spells Hope For Financial Markets & Crypto

Transitioning into the new year, 2023, feels like a much-needed fresh start on many accords. 2022 delivered some of the toughest macroeconomic conditions many of us can remember in our lifetime, and crypto likewise suffered idiosyncratic disappointments.

Macro Lens

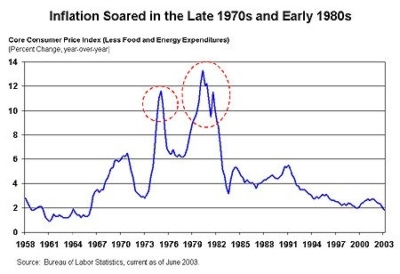

Moving into the new year the theme of high inflation rates will continue to be something to be key for market behavior. The good news is that there is a fair chance that inflation has already topped out for now. At least, that’s what the smartest macro brains I know are hypothesizing.

The decrease in inflation will positively impact emerging and future technology, whose valuations today are highly based on future value. In order words, we might get relief from the downside pressure that has been hovering above the markets as inflation numbers gradually improve.

Macro commentators much wiser than me (such as Michael Berry) comment that there’s a chance inflation rates might form multiple peaks before stabilizing at lower levels. Such a scenario will undoubtedly result in longer-term volatility for markets as central banks might be inclined to yo-yo back and forth between Hawkish and Dovish financial policy.

Others believe that the times of a 2% target inflation is something of the past and that central banks will be forced to higher the norm for what we can believe inflation to be. Both scenarios will be good for markets in the longer term.

Central Banks Still Not Hitting the Breaks

We are yet to see central banks transition into a more dovish stance on their economic and fiscal policies but around macro commentators, a consensus seems to be slowly forming that Q1 and Q2 of 2023 may introduce easier language on economic policy and potentially a slowdown or even halt of the planned future rate hikes.

Regardless, it should already be clear that 2023 is not going to be a walk in the park, and that headwinds will remain present even if we get sporadic relief from the unpleasantness that has made up the majority of 2022.

What is always worth noting, is that markets are forward-facing valuations and that the opportunistic probability may be that the worst is indeed behind us.

Crypto Lens

As the first order of impact to the rising inflation and central bank-induced rate hikes, crypto has had a first-row seat to the turbulence caused by macro conditions. This turbulence caused crypto markets to tumble dramatically during 2022 washing out speculators who jumped ship very late in the cycle.

And as liquidity drained from the ecosystem (especially) during Q2 and Q3, institutional actors (Voyager, 3AC, Celsius, FTX, etc.) faced severe liquidity crunches which forced many to trim their business significantly or outright face insolvency. Grim.

Such events bear systemic character for the industry and are not easily digested given no central authority (such as a central bank) is able to bail out actors.

Likewise, such dramatic events have caused tremendous damage to the industry’s reputation which will influence investors’ willingness to participate for some time.

This is not the first time crypto has stood before a healing process like this and basically every bear market in crypto prior to this one has also had devastating characteristics each in its own way.

What is significant this time around is a) that the crypto market is trading in a very unstable macro environment and b) that the systemic risks such as the Luna, 3AC, and FTX collapses have brought contagion in the industry in a very unprecedented way. For the industry to come out stronger from this industry needs to develop a higher degree of interdependence on central actors. After all, this is what decentralization is about, right?

Bitcoin: Long-Term Conviction in Charts

Despite a dreadful year for price action during 2022, the long-term conviction in Bitcoin among market participants continues to be strong.

In my opinion, Bitcoin continues to be the best barometer for the overall expected performance of the crypto markets as a whole, why the following charts focus entirely on the investor behavior around Bitcoin.

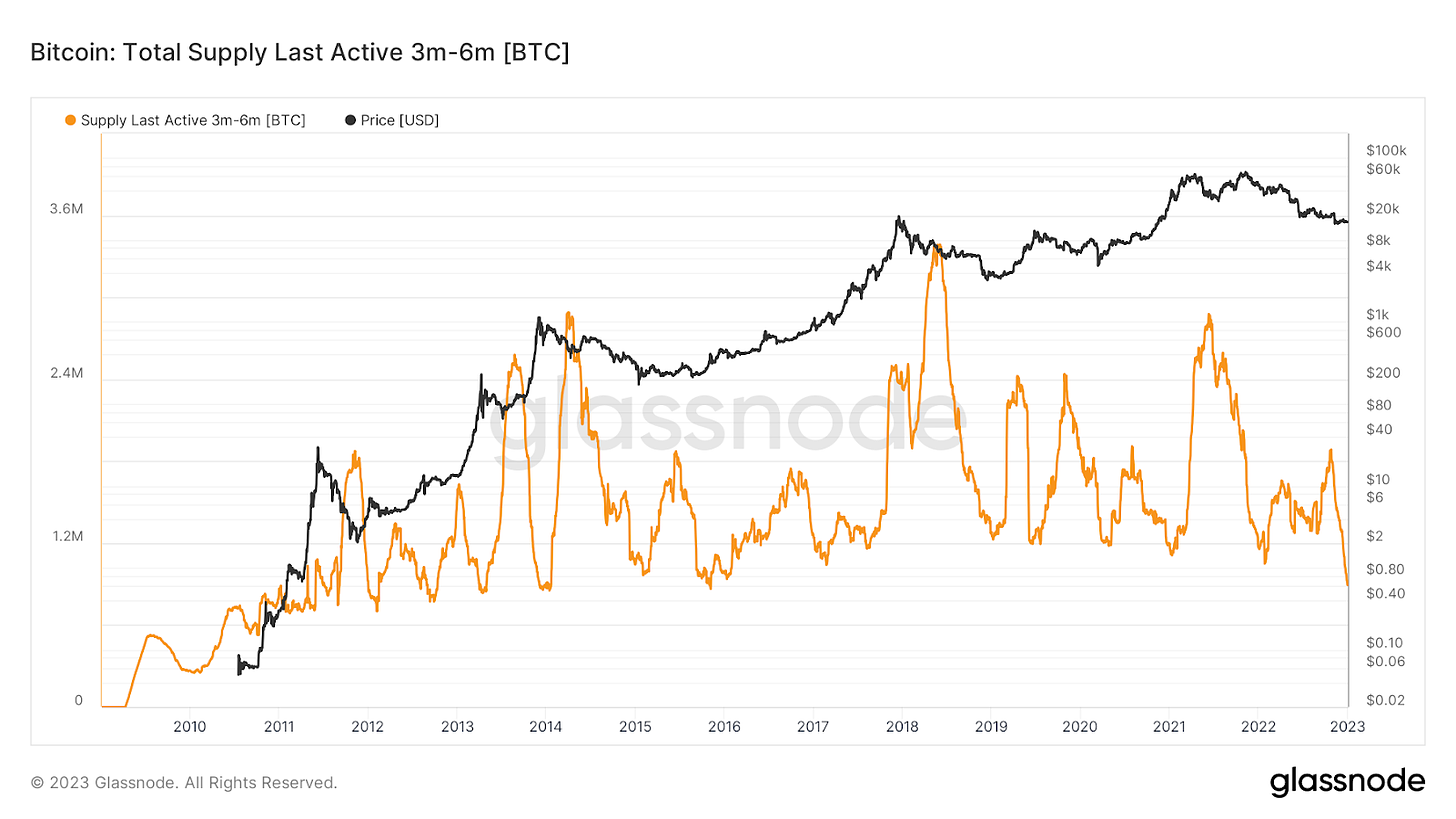

Supply Sitting Still

The amount of circulating supply last moved between 3 and 6 months ago and is currently sitting at a five-year low. In other words, there is a very small amount of the total circulating BTC supply that has been moved over the last 3 to 6 months. A signifier that long-term holders are sitting still and not making moves.

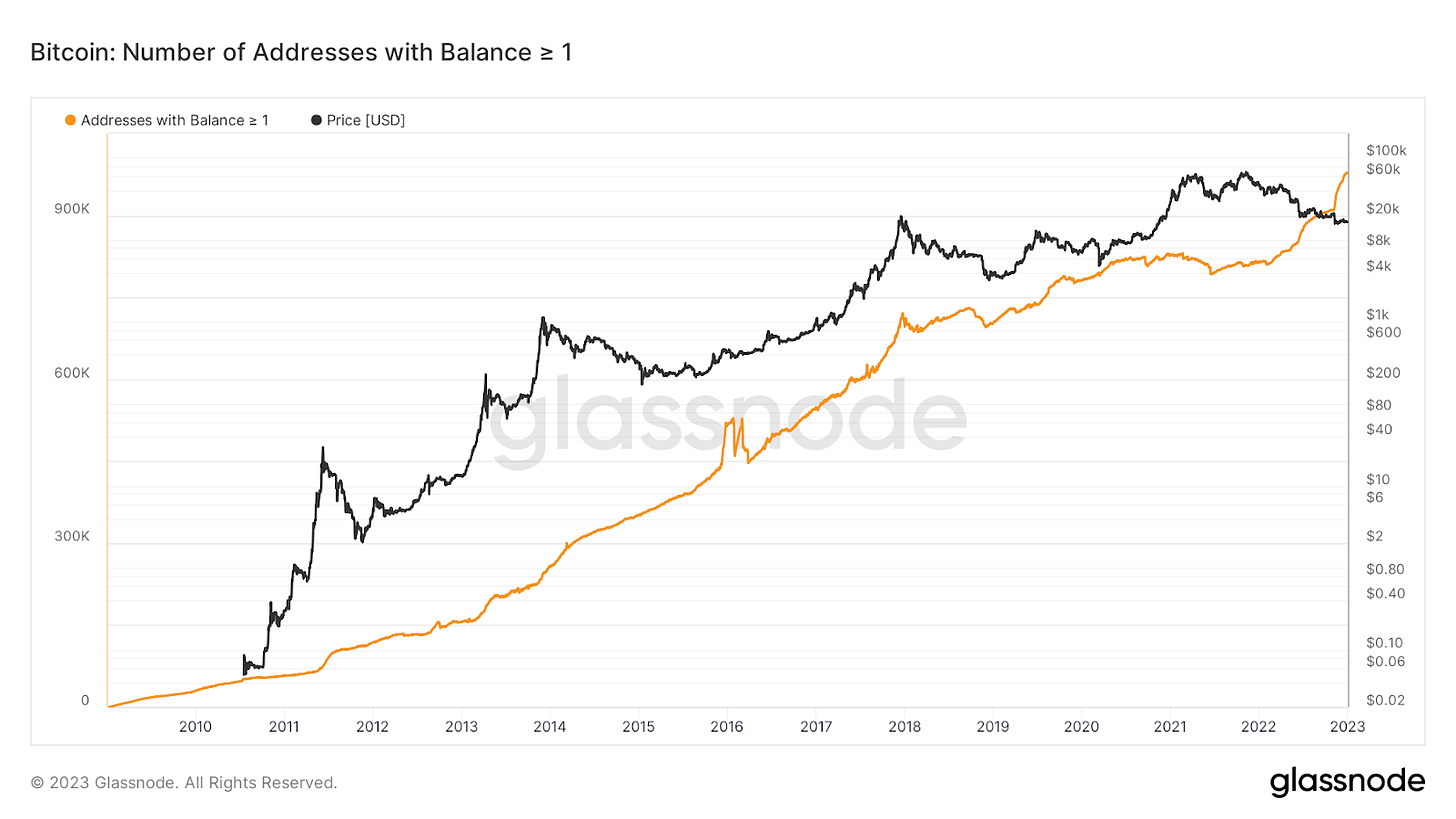

Amount of People Owning 1 BTC or More is Increasing Rapidly

This interestingly coincides with the fact that individual Bitcoin wallets holding more than 1 BTC are at an all-time high which should hint that the value on the network is getting dispersed among a bigger group of people basically increasing the decentralization of the Network. Not only should this show that individuals are getting more comfortable investing a higher dollar amount. After all, the price of 1 BTC is around 16.800 USD at the time of writing. Also, this trend will likely be positive for future price stability as supply will be divided among more different hands and decrease the centralization of value.

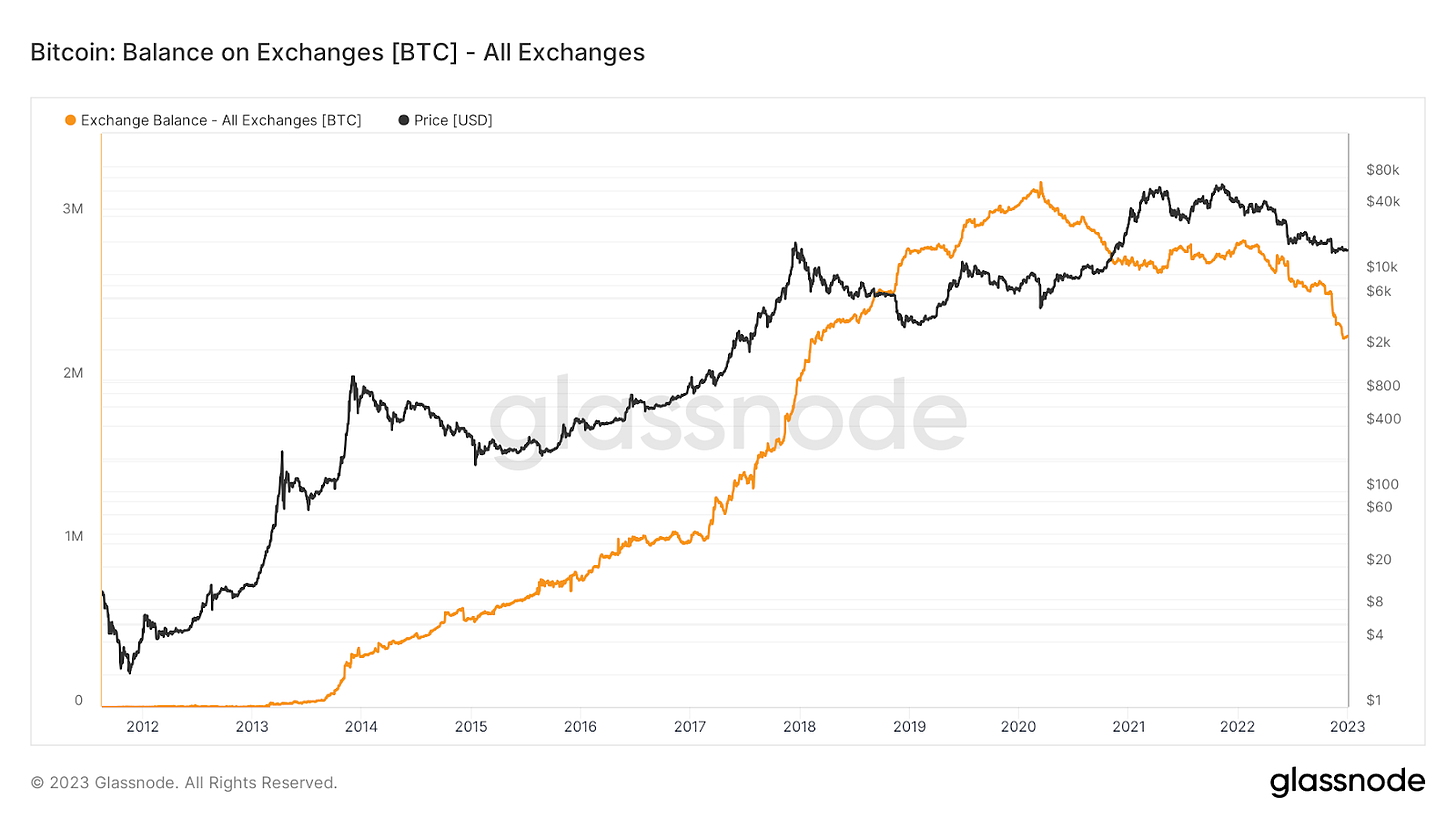

Bitcoin is Being Withdrawn From Exchanges

Lastly, it is worth noticing how the circulating supply has been leaving exchanges in a rapid fashion. This begs us to think that the collapse of FTX has perhaps re-ignited the idea of self-custody. The decrease in BTC supply on exchanges lowers the amount of BTC that can be sold at the market at a rapid rate, making accelerated downside movements more unlikely.

Notable News

Layoffs in the Crypto Industry

As we start the new year, it is likely that most crypto companies will continue with a conservative hiring approach. On the extremes, we might see more layoffs across the industry.

Troubled DCG Group Receives Offers

Valkyrie Investments, a Tennessee-based asset manager, has revealed its intention to become the new sponsor of Grayscale's Bitcoin Trust (GBTC). I feel confident that bigger investors will remain interested in GBTC due to the profitability of the trust in management fees alone.

MicroStrategy has added 2,395 BTC to its stockpile over the past two months, at an average price of approximately $17,871 per Bitcoin, inclusive of fees and expenses. The business intelligence firm now owns a total of 132,500 Bitcoins, making it one of the largest BTC holders. However, the total BTC investment is still underwater, having purchased all the coins at an average price of $30,397 per Bitcoin, including fees and expenses.

Miner’s in Trouble Seeking Bailouts

Bitcoin miners that were on the brink of collapse are finally getting some reprieve, with well-established investment firms coming to the rescue. Most notably, Bitcoin mining firm Argo recently received a $100 million bailout from Galaxy Digital to support its restructuring efforts. Meanwhile, BlackRock has committed $17 million to Core Scientific, which filed for Chapter 11 bankruptcy on December 21, 2022.

Italy Approves 26% Crypto Gains Tax

Crypto traders in Italy will be subject to a 26% capital-gains tax starting in 2023, following parliamentary approval of a new budget on December 29, 2022. The 387-page budget legitimizes crypto assets by defining them as "a digital representation of value or rights, which can be transferred and stored electronically, using the technology of distributed ledger or a similar technology." The move comes ahead of the much-awaited European Union's Markets in Crypto Assets (MiCA) which is set for a final vote this year.